Dozens of events took place across the US and Europe as part of “Stop Funding Tar Sands: Day of Solidarity with Frontline Communities."

(October 2, 2020) Dozens of events took place across the country today as part of “Stop Funding Tar Sands: Day of Solidarity with Frontline Communities,” an international day of demonstrations against the financing of tar sands pipelines that are harming Indigenous communities and the climate.

The protests were coordinated by Stop the Money Pipeline, a coalition of over 130 groups working to end the financing of climate destruction, and linked together in a Digital Rally that went live to protest after protest.

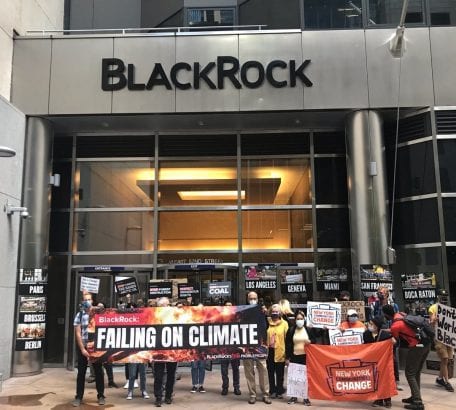

The day’s actions kicked off with a protest at BlackRock’s European headquarters in London and then moved coast to coast across the United States and Canada.

In Boston, a group led by local Indigenous women, built a mock pipeline outside the headquarters of Liberty Mutual, one of the world’s biggest insurers of the fossil fuels driving the climate crisis. Protestors urged Liberty Mutual to stop insuring Keystone XL, cut ties with the tar sands industry, and meet with Indigenous leaders, which the company has so far refused to do. The pipeline was covered in red handprints to represent missing and murdered Indigenous women, a tragedy exacerbated by fossil fuel operations.

“We are here to stand in solidarity with tribal nations who have fought Keystone XL for over ten years,” said Eva Blake, Assonet Wampanoag, with the Indigenous Environmental Network. “This pipeline violates treaty rights and sets the stage for more missing and murdered Indigenous women. We have had enough. Liberty Mutual needs to meet with tribal leaders and drop Keystone XL!”

In New York City, dozens of people started the afternoon of protests outside of JP Morgan Chase’s headquarters, chanting, “Jamie Dimon, you can’t hide, we can see your greedy side!” Chase locked all the entrances to the building to prevent protestors from entering. At the same time, activists from around the country left messages for Chase board members and executives demanding they stop funding fossil fuels. The protestors in NYC then marched on to BlackRock’s offices to demand the investment giant stop pouring money into fossil fuels.

In Minnesota, 30 youth leaders blockaded a Chase Bank branch in St. Paul to demand it defund tar sands, respect Indigenous rights, and stop the Line 3 pipeline. Calling in live from the protest, Tara Houska, Couchiching First Nation, founder of the Giniw Collective, and a steering committee member of Stop the Money Pipeline, said, “It’s incredibly important that we stand up in all the ways we can, and that includes divesting from the banks that fund these projects, because they all need money to run.”

More actions took place in Vancouver, Chicago, Charlotte, Providence, El Paso, Chico, and elsewhere across the country.

Activists, Indigenous leaders, and community members also joined the Digital Rally from frontline tar sands fights across North America.

They included Nigel Robinson, a member of the Łuéchogh Túé First Nation and activist with the Beaver Hills Warriors, called in from near what is now called Cold Lake in Alberta, saying, “These insurance companies like Liberty Mutual, they’re working hand in hand with Alberta Premier Jason Kenney to oppress people up here. A lot of our community members are suffering in big ways. A lot of our problems have to do with fossil fuels.”

Kanahus Manuel, of the Secwepemc Ktunaxa First Nation and Tiny House Warriors, joined from an ongoing blockade of the Trans Mountain Pipeline, saying, “We want to raise the risk for insurance companies who are underwriting these projects. We’ve been blockading this site for two years and we’re going to continue to ramp up our direct action.”

Youth leaders with the Cheyenne River Grassroots Collective, who are fighting the Keystone XL pipeline in what is now known as South Dakota, echoed her call, demanding that Liberty Mutual stop insuring the pipeline and banks pull out their support for the project.

Lucy Molina, a frontline community organizer resisting the Suncor tar sands refinery in Commerce City, CO, issued a direct challenge to banks like JP Morgan Chase, “Stop banking on human misery. Our families are dying. Our children are losing their education because they’re always sick. Your money is killing our children, our neighbors, and the people that we love.”

The organizers’ goal was to shine a spotlight on three major financial institutions, JPMorgan Chase, Liberty Mutual, and BlackRock, that are financing, insuring, and investing in three of the most dangerous fossil fuel projects in North America: the Line 3, Trans Mountain, and Keystone XL pipelines.

Line 3 would run across Anishinaabe territory and Ojibwe treaty lands in Minnesota to refineries on Lake Superior; Trans Mountain across lands in British Columbia belonging to First Nations including Squamish, Tsleil-Waututh, Coldwater and a collective of bands within the Sto:lo Nation; and Keystone XL across the Fort Belknap Indian Community of Montana, the Rosebud Sioux Tribe of South Dakota, and lands in Nebraska.

Each pipeline would transport Canadian tar sands, some of the dirtiest fossil fuels on the planet, and would be constructed on Indigenous lands without consent, endangering the safety of Indigenous women, and violating Indigenous People’s right to Free Prior and Informed Consent.

Along with fighting the pipelines on the ground, Indigenous leaders and their allies have been going after the financial institutions that are funding the projects.

Those include JPMorgan Chase, which is the number one U.S. banker of tar sands oil, financing more tar sands between 2016 and 2019 than the other five big U.S. banks combined. During that period, Chase provided TC Energy, the company behind the Keystone XL pipeline, with $17.5 billion in financing, making TC Energy the bank’s single largest fossil fuel client. Despite the bank’s green rhetoric, its tar sands financing jumped 65% from 2018 to 2019.

Liberty Mutual is also a key player in the tar sands. The insurance company is insuring the Trans Mountain pipeline in Canada as well as providing key financial backing for the Keystone XL pipeline: Liberty Mutual provided a $15.6 million bond to TC Energy, the company behind the project, to cover any damages to public infrastructure in South Dakota that could result from constructing the pipeline. The Great Plains Tribal Chairman’s Association issued a letter this September calling on Liberty Mutual to drop the project. While information on eight insurers of the Line 3 pipeline isn’t publicly available, it’s highly likely that Liberty Mutual is one of them. Liberty Mutual currently has no policies in place to steer clear of projects that have not secured the Free, Prior, and Informed Consent of Indigenous communities.

On September 15th, the Chairmen of sixteen sovereign Tribal Nations wrote to Liberty Mutual CEO, David Long, to demand that Liberty Mutual immediately cut ties with the Keystone XL pipeline and meet with them to discuss Liberty Mutual’s involvement in the whole tar sands sector. This was followed the next day by sixty major businesses calling on insurers to cease doing business with the fossil fuel industry.

BlackRock is also a major investor in tar sands. Despite BlackRock’s promises to put sustainability at the center of its business model, it remains the world’s top backer of fossil fuels and deforestation. While BlackRock made headlines for excluding tar sands from a single ESG fund, it has no policies in place to stop its other funds from investing in them. BlackRock is also a major investor in TC Energy and Enbridge, the companies behind Keystone XL, Line 3, and Trans Mountain. Furthermore, BlackRock is a top shareholder of many of the largest banks financing tar sands and pipeline expansion. BlackRock has also failed to incorporate Indigenous rights into any of its investment screens.

“So far BlackRock is failing to meet the big climate promises it made in January. It’s saying many of the right things but when you consider the actions of the world’s largest asset manager, they simply don’t rise to the urgency of the crises or its own promise to center sustainability in its business model,” said Moira Birss, Climate and Finance Director for Amazon Watch. “Excluding tar sands from its investment funds is one of the big next steps BlackRock must take to be the climate leader it claims to be.”

As the day’s protests and digital rally came to a close, organizers with Stop the Money Pipeline pledged to keep up the pressure on major financial institutions to stop funding the tar sands and other dangerous fossil fuel projects that threaten the climate, Indigenous sovereignty, and human rights.