Reports

How the financial industry funds destruction

Research and reports detailing how BlackRock and Big Finance are fuelling a global crisis – and how they can lead change.

Failure by Design: Is the Net Zero Asset Managers Initiative Broken?

As things stand, the ‘net zero’ in NZAMI is a misnomer. Their headline ambition – a 15-26% cut in emissions by 2030 – is barely half of what is required for the world to stay on track with net zero. But once we take into account the initiative’s loopholes, we find that asset managers have on average made pledges that are consistent with aligning just a few percent of their emissions with net zero.

A Leaf Out of an Old Book: How the LEAF Coalition Enables Market Colonialism

Amazon Watch has serious concerns that the LEAF Coalition’s agreement with the Ecuadorian Ministry of the Environment is yet another example of carbon offset programs serving as a dangerous distraction from climate justice. Programs like the LEAF Coalition threaten to create a false “green” veneer over continued threats to Indigenous rights while enabling extractive industries and further commoditizing communities’ relationships with nature.

The Asset Managers Funding Climate Chaos: 2022 scorecard on asset managers, fossil fuels and climate change

More than seven years after the Paris Agreement was signed, our 2022 scorecard reveals that the biggest asset managers still have not taken appropriate steps to tackle fossil fuel expansion, a basic prerequisite to keeping global warming in check. While many acknowledge the need to organize a managed decline of the oil and gas industry, these firms are still investing billions into companies whose fossil fuel expansion plans make this objective impossible to achieve.

Vanguard’s Empty Promises: How Vanguard Funds Harm and Fuels Extractive Industry

This report (1) critiques Vanguard’s governance practices and charitable giving vehicles and (2) highlights how Vanguard’s loose definitions of social justice and inadequate screening tools allow capital to be deployed to extractive industries via funds touted as both environmentally and socially responsible. While frontline BIPOC communities have been demanding divestment from extractive industries for years, Vanguard’s investment vehicles remain financial drivers of harmful industry.

Finance and Climate Change

A comprehensive assessment of the world's 30 largest listed financial institutions shows a clear disconnect between the concrete short-term targets and actions needed to address the climate emergency and the limited, long-term targets currently being set by the financial sector. The research indicates a widespread lack of integration of high-level climate commitments into business segment processes.

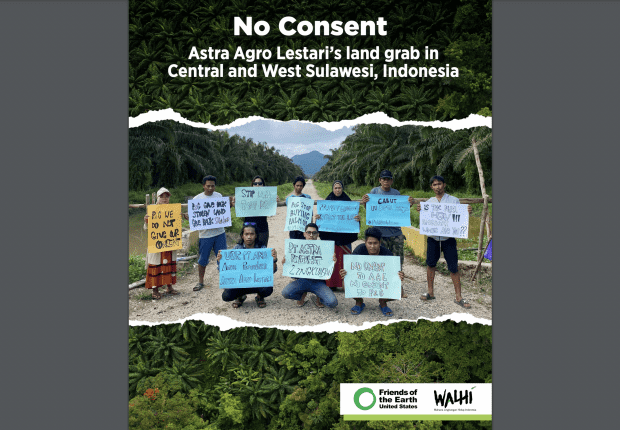

No Consent: Astra Agro Lestrari’s land grab in Central and West Sulawesi, Indonesia

BlackRock and Vanguard are two of the largest shareholders in Astra Agro Lestrari (AAL). Through its subsidiaries PT Agro Nusa Abadi, PT Lestari Tana Teladan, and PT Mamuang, AAL is responsible for numerous environmental, human rights, and governance violations.

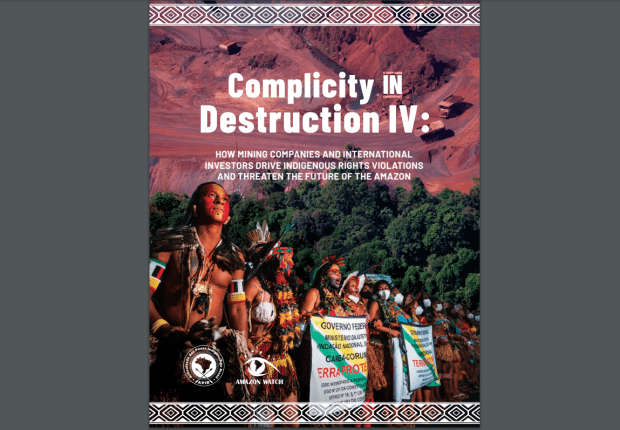

Complicity in Destruction IV – How mining companies and international investors drive Indigenous rights violations and threaten the future of the Amazon

This fourth edition of the Complicity in Destruction series, developed jointly by the Association of Brazil’s Indigenous Peoples (APIB) and Amazon Watch, briefly summarizes the history of large-scale mining in Brazil, with particular focus on its encroachment upon Indigenous lands, and highlights the growing momentum that the activity has gained under the Bolsonaro administration. Today, the deadly mining industry continues to cast its shadow over Brazilian Indigenous territories and the Amazon rainforest.

Climate in the Boardroom: How Asset Manager Voting Shaped Corporate Climate Action in 2021

In 2021, proxy voting by asset managers with over $1 trillion in AUM remained insufficient to the scale and urgency of the climate crisis. Without additional board-level accountability from these largest and most influential shareholders to transition to net-zero pathways, companies in climate-critical industries such as oil and gas, electricity production, and financial services will continue to drive warming beyond 1.5°C—threatening the lives and livelihood of millions and placing trillions of dollars of shareholder value and financial system stability at increasing risk.

DRILL, BABY, DRILL: How banks, investors and insurers are driving oil and gas expansion in the Arctic

Our capacity to protect the Arctic is a litmus test for our capacity to protect

our planet and its ecosystems. Tragically, this report reveals that a toxic combination of fossils and finance is setting us on the path to failure.

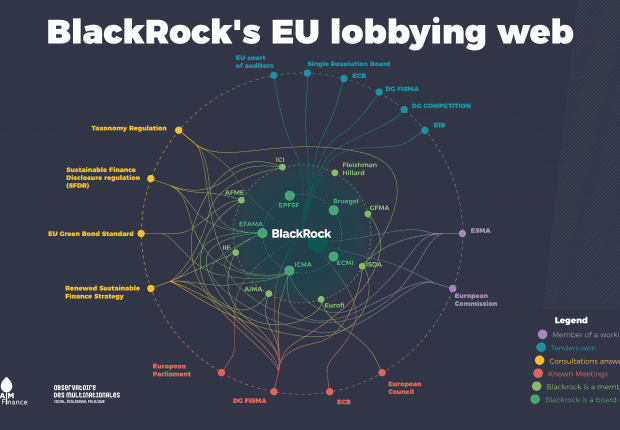

HIJACKED: Exposing BlackRock’s Grip on the EU’s Climate Finance Plans

Reclaim Finance and the Observatoire des multinationales have revealed the extent of BlackRock’s influence over the EU’s climate finance plans. The report, entitled “Hijacked: Exposing BlackRock’s Grip on the EU’s Climate Finance Plans”, finds that the world’s largest asset manager sits at the heart of a lobbying web with privileged access to European institutions. The report raises the alarm on the climate rulebook defended by BlackRock and friend groups. While opposing any kind of (even minimal) climate-related restrictions that would be imposed on financial players and their investment choices, the alternative they push forward is highly problematic.

Investing in Amazon Crude II: How the Big Three Asset Managers Actively Fund the Amazon Oil Industry

Three of the world's largest asset managers – BlackRock, Vanguard, and State Street – with trillions of dollars under their control, invest in oil companies with horrific environmental and human rights records across the Amazon Basin.

Right now, these asset managers hold a large amount of risk by actively contributing to Indigenous and human rights abuses, forest destruction, biodiversity loss, and climate chaos. The "Big Three" can't claim to be climate champions while steering client money into oil drilling in the rainforest.

SLOW BURN: The asset managers betting against the planet

Reclaim Finance's new scorecard on leading asset managers’ climate commitments, focusing on their approach to the coal sector. Produced with four partner NGOs from across Europe and North America, the report compares 29 asset managers, with a focus on the European market. The authors reveal that despite 16 asset managers holding long-term climate commitments, nearly all are failing to take the first step to making them a reality: exiting coal.

BlackRock’s Net-Zero Commitment Put To The Test

A new report from Reclaim Finance shows that BlackRock, the world’s largest asset manager, holds over $75 billion in thirty major tar sands production companies, all of which plan to develop new reserves of the world’s dirtiest form of oil. BlackRock also holds $3.7 billion in three pipeline companies engaged in the construction of controversial pipelines transporting tar sands oil from Alberta Canada, including Line 3.

One Year On: BlackRock Still Addicted to Fossil Fuels

One year after BlackRock’s CEO promised sustainability would be at the heart of investment decisions, a report by NGOs Reclaim Finance and Urgewald has revealed that BlackRock remains a massive investor in coal companies, even in those with expansion plans related to coal. The analysis unveils huge gaps in BlackRock’s policy, both in its coal policy and in the complete absence of a policy on other fossil fuels.

Fossil Fuel Lobbyists Are Dominating Climate Policies During COVID-19

New research from InfluenceMap shows the oil and gas sector to have dominated climate-related policy battles throughout COVID-19 crisis. Interventions from the industry seeking deregulation and support for fossil fuels in recovery packages have drowned out pro-climate interventions from the non-fossil corporate sector.

The New Money Trust: How Large Money Managers Control Our Economy and What We Can Do About It

This paper will discuss the concerns that the outsized growth of the fund industry, especially its three largest participants, poses for corporate governance, competition, and financial market stability. It then explores some policy solutions to address the financial risks and anticompetitiveimpacts of large asset managers.

How Dodd Frank Can Address Wall Street’s Role In The Climate Crisis

In this paper, Graham Steele argues that a sustainable shift to green energy requires a significant reallocation of this capital and that the Dodd-Frank Act provides the regulatory tools to require financial institutions to internalize the financial risks associated with lending and investments that drive climate change.