Case studies

How the financial industry funds destruction

Case studies that explore how fossil fuels, deforestation, and human rights violations threaten our climate.

Biomass Electricity & Drax

BlackRock is a major investor in the world’s biggest biomass burner, UK-based Drax Plc. Formerly a coal-fired power station, Drax has been increasing its biomass burning since 2012. It now imports and burns more wood than the UK can produce every year, emitting 13 million tonnes of CO2 annually. Biomass is often classified (and subsidised) […]

12 Projects Wrecking Paris

Banks and investors like BlackRock continue to pour billions into the fossil fuel companies developing large-scale, contested coal, oil, and gas expansion projects. In December 2020, on the fifth anniversary of the Paris Climate Agreement, a new report highlighted 12 mega projects that alone will use up 75% of our global carbon budget if we are to limit warming to 1.5 degrees Celsius. BlackRock is the top investor in the report’s coal, oil, and gas companies.

Global Coal

Coal is the world’s deadliest fossil fuel, damaging people’s health, destroying local ecosystems, and acting as the number-one driver of climate change worldwide. All scenarios aiming to keep the world at a safe temperature – including the Paris Agreement – involve rapidly phasing out coal.

Amazon deforestation

The Amazon is the world’s largest rainforest. It’s critical for biodiversity and climate regulation, because it ‘pumps’ water into the air (like a heart) to produce rain and cool the earth. The Amazon is the world’s largest carbon sink, storing an estimated 150-200 billion tons of carbon. It also houses at least 10% of the planet’s known biodiversity, and is home to over 400 distinct groups of Indigenous peoples, who have protected this crucial ecosystem for centuries.

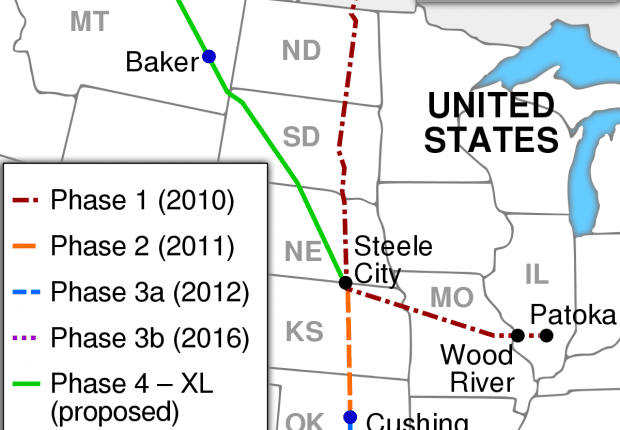

Pipeline: TC Energy and Keystone XL

TC Energy, formerly known as TransCanada, has been attempting to build the Keystone XL tar sands pipeline since 2008. For over a decade, Indigenous leaders, water protectors, environmentalists, ranchers, and lawyers have been resisting the project, engaging in direct actions, and waging a series of legal battles challenging the construction of the controversial pipeline.

Pipeline: Enbridge and Line 3

Enbridge Inc. has a track record of oil spills and Indigenous rights violations. The company has been pushing to replace its existing Line 3 pipeline with a larger pipe that would carry 760,000 barrels of tar sands oil per day from Edmonton, Alberta, to Superior, Wisconsin. In November 2020, Enbridge secured final permits for Line 3 from Minnesota and the federal government and began construction in December, despite COVID risks, legal challenges, and sustained Indigenous-led opposition to the project. When construction started, BlackRock had $336 million invested in Enbridge.

Tar Sands & Pipelines

The Northern Alberta tar sands are the third-largest fossil fuel reserve on earth. Tar sands oil is fused within underground soil deposits, making its extraction extremely destructive by digging through kilometers of boreal forest, and water and energy-intensive by separating the oil from the soil using steam injected underground. BlackRock has billions of dollars invested in tar sands companies.