Facts

The facts about Big Finance and climate chaos

Reports, FAQs, and case studies detailing how BlackRock and the financial industry are fuelling a global crisis – and how they can lead change.

Failure by Design: Is the Net Zero Asset Managers Initiative Broken?

As things stand, the ‘net zero’ in NZAMI is a misnomer. Their headline ambition – a 15-26% cut in emissions by 2030 – is barely half of what is required for the world to stay on track with net zero. But once we take into account the initiative’s loopholes, we find that asset managers have on average made pledges that are consistent with aligning just a few percent of their emissions with net zero.

A Leaf Out of an Old Book: How the LEAF Coalition Enables Market Colonialism

Amazon Watch has serious concerns that the LEAF Coalition’s agreement with the Ecuadorian Ministry of the Environment is yet another example of carbon offset programs serving as a dangerous distraction from climate justice. Programs like the LEAF Coalition threaten to create a false “green” veneer over continued threats to Indigenous rights while enabling extractive industries and further commoditizing communities’ relationships with nature.

The Asset Managers Funding Climate Chaos: 2022 scorecard on asset managers, fossil fuels and climate change

More than seven years after the Paris Agreement was signed, our 2022 scorecard reveals that the biggest asset managers still have not taken appropriate steps to tackle fossil fuel expansion, a basic prerequisite to keeping global warming in check. While many acknowledge the need to organize a managed decline of the oil and gas industry, these firms are still investing billions into companies whose fossil fuel expansion plans make this objective impossible to achieve.

Vanguard’s Empty Promises: How Vanguard Funds Harm and Fuels Extractive Industry

This report (1) critiques Vanguard’s governance practices and charitable giving vehicles and (2) highlights how Vanguard’s loose definitions of social justice and inadequate screening tools allow capital to be deployed to extractive industries via funds touted as both environmentally and socially responsible. While frontline BIPOC communities have been demanding divestment from extractive industries for years, Vanguard’s investment vehicles remain financial drivers of harmful industry.

Finance and Climate Change

A comprehensive assessment of the world's 30 largest listed financial institutions shows a clear disconnect between the concrete short-term targets and actions needed to address the climate emergency and the limited, long-term targets currently being set by the financial sector. The research indicates a widespread lack of integration of high-level climate commitments into business segment processes.

No Consent: Astra Agro Lestrari’s land grab in Central and West Sulawesi, Indonesia

BlackRock and Vanguard are two of the largest shareholders in Astra Agro Lestrari (AAL). Through its subsidiaries PT Agro Nusa Abadi, PT Lestari Tana Teladan, and PT Mamuang, AAL is responsible for numerous environmental, human rights, and governance violations.

What can BlackRock really do, given that it works with client money?

Larry Fink has said that climate change is a major threat to clients’ investments, so continuing to support the companies driving climate change makes BlackRock part of that threat. There is an inherent conflict between the long-term survival of companies whose core business model is based on fossil fuels or deforestation and the long-term existence of life as we know it. Continuing to hold fossil fuel companies in a portfolio is an abdication of long-term fiduciary responsibility. Until it pursues action that aims to materially reduce greenhouse gas emissions, BlackRock is trying to have its cake and eat it, too.

What does Fiduciary Duty mean for BlackRock’s ability to act on climate?

Climate change poses an enormous systemic risk to our economy. So much so that Larry Fink himself said that climate change will reshape finance. Given the systematic threat of climate change, the only way a financial firm can fulfill its long-term fiduciary duty to its clients is by proactively acting to mitigate the climate crisis. Financial firms that do not take the climate impact of their investments into account are not acting in the best interest of their clients or our economy.

Do you expect BlackRock or the economy to change overnight?

Of course not. Change takes time, but we need bold and visionary leadership right now – while we still have a chance to avoid the worst impacts of the climate crisis. We can’t rely on incrementalism while the world burns. Larry Fink says coal won’t disappear tomorrow, but science says we need to stop burning coal as quickly as possible, so funnelling dollars into the industry just pushes us closer to the brink. This all comes down to one simple truth: humanity must avoid catastrophic climate change. Asset managers who publicly acknowledge this truth while propping up companies that drive us toward catastrophe are not leaders or visionaries, and they are certainly not putting sustainability at the center of their investment decisions.

If BlackRock stops investing in fossil fuels and other climate-harming companies, will another investor just step in?

Fewer institutional investors are buying energy stocks, and, for many companies, institutional investors are reducing the size of their fossil fuel holdings. The energy transition, in which global economic growth is increasingly decoupled from fossil fuel use, is underway. As energy stocks have become less relevant, other sectors are moving forward.

What can BlackRock do about its passive investments in companies driving the climate crisis?

True climate leadership must include taking responsibility for avoiding systemic impacts to the financial system and economy overall. BlackRock’s existing portfolio, unchecked, is driving runaway climate change. The notion that passive funds are derived through objective analyses of the market is simply not true, in reality index funds are “passive in name only.” Selection criteria are created by fund managers, and their methodologies shift regularly. It is past time for fund managers to think seriously about how climate change is a crucial criterion.

How are Indigenous rights connected to deforestation and climate change mitigation?

Studies have shown that Indigenous peoples are the best protectors of forests, and that when Indigenous peoples’ rights to autonomy and self-determination are respected, the territories they control remain biodiverse and intact. Given that deforestation is the second largest driver of climate change worldwide following fossil fuel extraction, prioritizing Indigenous rights is a crucial part of protecting the world’s rainforests, which are some of the most important strongholds for climate change mitigation.

Just as BIPOC people have been challenging the white supremacist legacy of slavery in the United States for centuries, Indigenous peoples in the Amazon have been fighting for centuries to defend their ancestral territories from colonialist exploitation and invasion. The exploitation of the Amazon today continues this pattern of colonialism and environmental racism. Almost all of the crude oil and agribusiness industries currently operating in the Amazon are owned and financed by European or U.S. corporations. This is why our work to get major financial institutions like BlackRock to stop financing the destruction of the Amazon is anti-colonialist and anti-racist work.

Biomass Electricity & Drax

BlackRock is a major investor in the world’s biggest biomass burner, UK-based Drax Plc. Formerly a coal-fired power station, Drax has been increasing its biomass burning since 2012. It now imports and burns more wood than the UK can produce every year, emitting 13 million tonnes of CO2 annually. Biomass is often classified (and subsidised) […]

12 Projects Wrecking Paris

Banks and investors like BlackRock continue to pour billions into the fossil fuel companies developing large-scale, contested coal, oil, and gas expansion projects. In December 2020, on the fifth anniversary of the Paris Climate Agreement, a new report highlighted 12 mega projects that alone will use up 75% of our global carbon budget if we are to limit warming to 1.5 degrees Celsius. BlackRock is the top investor in the report’s coal, oil, and gas companies.

Global Coal

Coal is the world’s deadliest fossil fuel, damaging people’s health, destroying local ecosystems, and acting as the number-one driver of climate change worldwide. All scenarios aiming to keep the world at a safe temperature – including the Paris Agreement – involve rapidly phasing out coal.

Amazon deforestation

The Amazon is the world’s largest rainforest. It’s critical for biodiversity and climate regulation, because it ‘pumps’ water into the air (like a heart) to produce rain and cool the earth. The Amazon is the world’s largest carbon sink, storing an estimated 150-200 billion tons of carbon. It also houses at least 10% of the planet’s known biodiversity, and is home to over 400 distinct groups of Indigenous peoples, who have protected this crucial ecosystem for centuries.

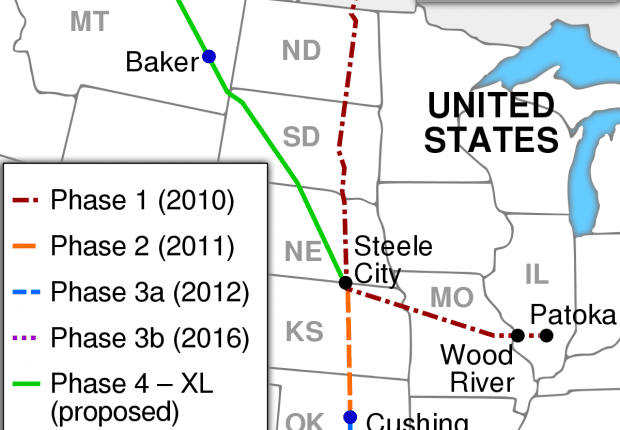

Pipeline: TC Energy and Keystone XL

TC Energy, formerly known as TransCanada, has been attempting to build the Keystone XL tar sands pipeline since 2008. For over a decade, Indigenous leaders, water protectors, environmentalists, ranchers, and lawyers have been resisting the project, engaging in direct actions, and waging a series of legal battles challenging the construction of the controversial pipeline.

Pipeline: Enbridge and Line 3

Enbridge Inc. has a track record of oil spills and Indigenous rights violations. The company has been pushing to replace its existing Line 3 pipeline with a larger pipe that would carry 760,000 barrels of tar sands oil per day from Edmonton, Alberta, to Superior, Wisconsin. In November 2020, Enbridge secured final permits for Line 3 from Minnesota and the federal government and began construction in December, despite COVID risks, legal challenges, and sustained Indigenous-led opposition to the project. When construction started, BlackRock had $336 million invested in Enbridge.