BlackRock’s recent statement on palm oil reveals an unhealthy addiction to climate risk

This article originally published on Medium.

BlackRock, the $6.5 trillion Wall Street asset manager, has quietly released a statement on the company’s approach to engagement in the palm oil sector — an industry notorious for its role in destroying the planet’s last forests.

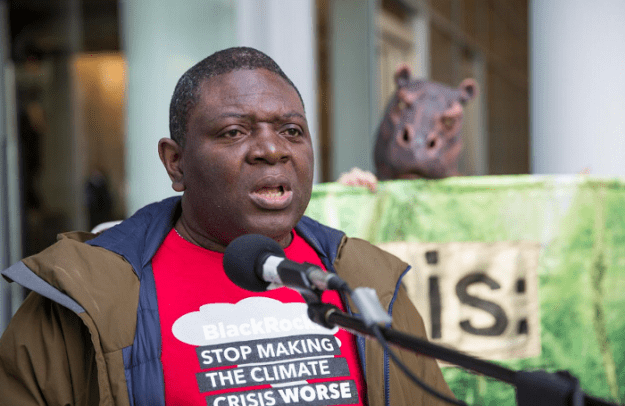

Given the role of the palm oil industry in driving species to extinction and heating up the global climate, the release of this statement is significant. This was the first time the firm publicly acknowledged the risks inherent in this sector, and it came on the heels of concerted public pressure. In February, eight U.S. senators sent BlackRock a letter asking the firm to disclose its approach to the deforestation wrought by the palm oil sector, in which it is a significant shareholder. In April, at a demonstration in front of its San Francisco headquarters, Liberian human rights attorney Alfred Brownell (winner of the prestigious Goldman Environmental Prize) delivered BlackRock a letter regarding its financing of Golden Agri-Resources, a palm oil company responsible for vast rainforest destruction, human rights abuses and illegal activities.

BlackRock previously recognized that deforestation presents a climate risk to investors, but BlackRock’s palm oil statement, released in May, was the first time the firm had publicly acknowledged the investment risks inherent in the palm oil sector. Yet the statement does little to address the core issues raised by the eight U.S. senators — and does nothing at all to assuage the concerns of Mr. Brownell, who is deeply aware that the forests of his home country continue to fall to the axe of companies financed, in part, by BlackRock.

In fact, as we explain in this analysis, BlackRock’s tepid statement says more about what the company won’t do about the deforestation crisis than about what it will. In the statement — which was not shared directly with any of BlackRock’s stakeholders or with the Senate offices that had written to the firm — BlackRock mentions its “constructive engagement” with seven palm oil companies in Southeast Asia and West Africa.

Looking at three companies that we can say with confidence are on BlackRock’s engagement list, one — Indofood Sukses Makmur — was dropped by Citibank last month for intractable labor abuses. A second, Sinar Mas, recently had several of its executives arrested for bribery in Indonesia. And a third, Golden Veroleum Liberia, allegedly continues to clear land on its Liberian concession in violation of a formal request by the Roundtable on Sustainable Palm Oil.

What does BlackRock expect to gain from engagement with a company whose executives are behind bars for bribery or with companies that have expressly violated the mandate of the industry’s sustainability body?

BlackRock’s addiction to destruction only gets worse. Besides dialogue with corporate management, another part of investor engagement is shareholder voting — and when it comes to climate change, BlackRock’s voting practices are among the worst in the fund industry. BlackRock supported only 10 percent of 2018 climate-related shareholder proposals.

Moreover, what BlackRock obfuscates in its statement is that even as it claims to be constructively engaged with the palm oil sector, its holdings in palm oil and several other deforestation-linked commodities have been increasing. Research from earlier this year finds that BlackRock has increased its holdings in palm oil, pulp and paper, beef, rubber and timber — all at a time when the world’s scientists have made it clear that we have roughly a decade to mitigate the extreme impacts of the climate crisis.

BlackRock’s big problems aren’t limited to palm oil. The financial giant is also the largest investor in new coal development, oil and gas companies and the agribusinesses driving deforestation around the world. This addiction to polluting industries isn’t healthy for BlackRock, its shareholders or the planet.

The first step in overcoming addiction is to get beyond denial. And the next step is kicking the habit.