Asset managers like BlackRock are overlooked but significant contributors to the climate crisis.

BlackRock is the largest asset manager in the world, with about $6.5 trillion in assets under management as of the end of March 2019. As of 2016, BlackRock owned more than 5 percent of over 2,600 companies and over 10 percent of 375 companies.

BlackRock talks a good game. CEO Larry Fink claims that he wants to be a leader in social responsibility and a force for more companies to have a “social purpose.” In fact, BlackRock recently made an attempt to build public goodwill by announcing plans for more transparency in its investments and the creation of a handful of “sustainable” funds.

But BlackRock’s investments and actions tell a very different story. Blackrock is the largest single owner of fossil fuels and deforestation-related commodities, which are the top two drivers of climate change. BlackRock is the biggest U.S. investor in coal, oil and gas, and rainforest destruction, thus contributing more to climate change than almost any other company on earth.

BlackRock has also failed to use its influence to push other companies to be better, voting in favor of just 10% of climate-related shareholder resolutions in 2018. And in 2017, BlackRock sided with management 14 out of 16 times, voting against shareholder resolutions which push for fossil fuel companies to measure and evaluate climate risks, create Paris-compliant business plans, limit lobbying activity against climate-related policies, etc.

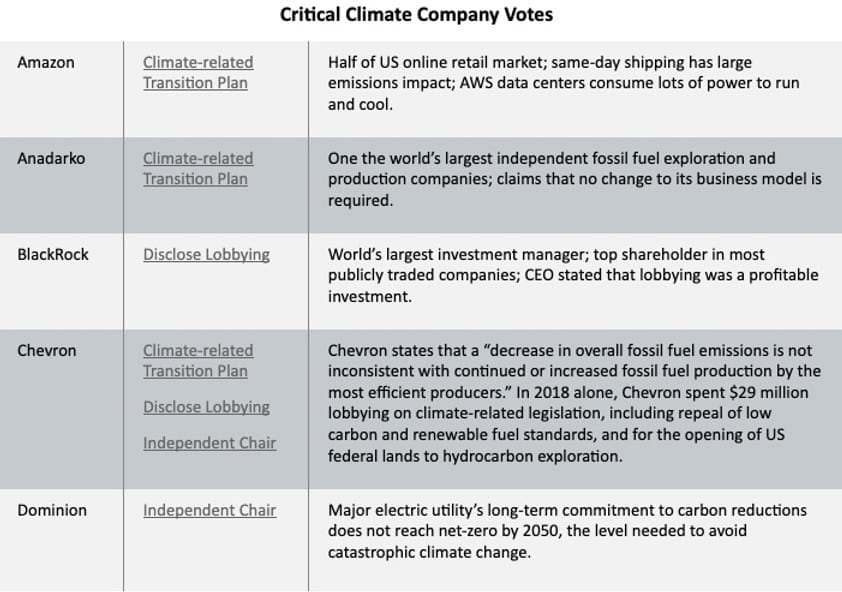

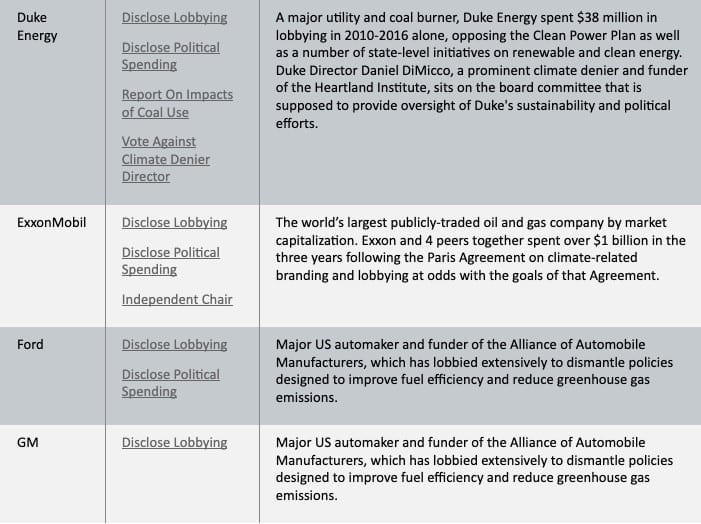

Key climate votes to watch this shareholder season. Given BlackRock’s lackluster record on pro-climate shareholder votes – despite its pro-climate rhetoric – we’re keeping a close eye this shareholder season on 17 key votes before the shareholders of massive energy producers and consumers like ExxonMobil, Ford, Duke Energy, Amazon, Chevron, and General Motors. The shareholders of these companies – including BlackRock – will decide if they will take steps to combat climate change and set the stage for others to do the same, or if they will keep us on the path towards climate catastrophe. Full list of key votes we’re watching here.

Duke Energy, for example, will face key votes on climate, lobbying, board membership and political spending at its May 2nd shareholder meeting. This comes in the midst of controversy surrounding Duke: earlier this month it abruptly left the Utility Air Regulatory Group (UARG) – the controversial industry group which has long rallied against, and at times sued, the U.S. Environmental Protection Agency against tougher clean air standards. This coincided with the launch of a House Energy and Commerce Committee-led investigation into UARG, which aims to evaluate whether ethics violations occurred and whether membership dues were paid by ratepayers or by shareholders of the member groups. (Politico story on this here.)

Notably, two of the key shareholder votes are related to this issue: one resolution calls for greater lobbying disclosure, and shareholders will vote on whether to re-appoint board member and climate denier Daniel DiMicco, who has been one of the biggest donors to the Heartland Institute, a primary promoter of climate denial theories.

About the BlackRock Big Problem campaign: BlackRock’s Big Problem is a global network of NGOs and social movements that are pressuring asset managers like BlackRock to align their business practices with a climate-safe world. Members include Sierra Club, Amazon Watch, Friends of the Earth, DivestInvest, Sunrise Project, and Majority Action.

For further information contact: diana@sunriseproject.org.au

The full list of key votes is on the Majority Action website.