With the vote at MUFG’s AGM on June 29, we closed one of the most dynamic shareholder seasons that North America and Europe have ever seen. After years of organizing by climate activists, NGOs, and progressive investors, this season we witnessed a revolt where shareholders finally claimed their power and showed deep frustration at companies failing to change course on climate.

What role did BlackRock and Vanguard play in the revolt? Of the critical climate votes we watched closely this year, here is what we know and don’t know:

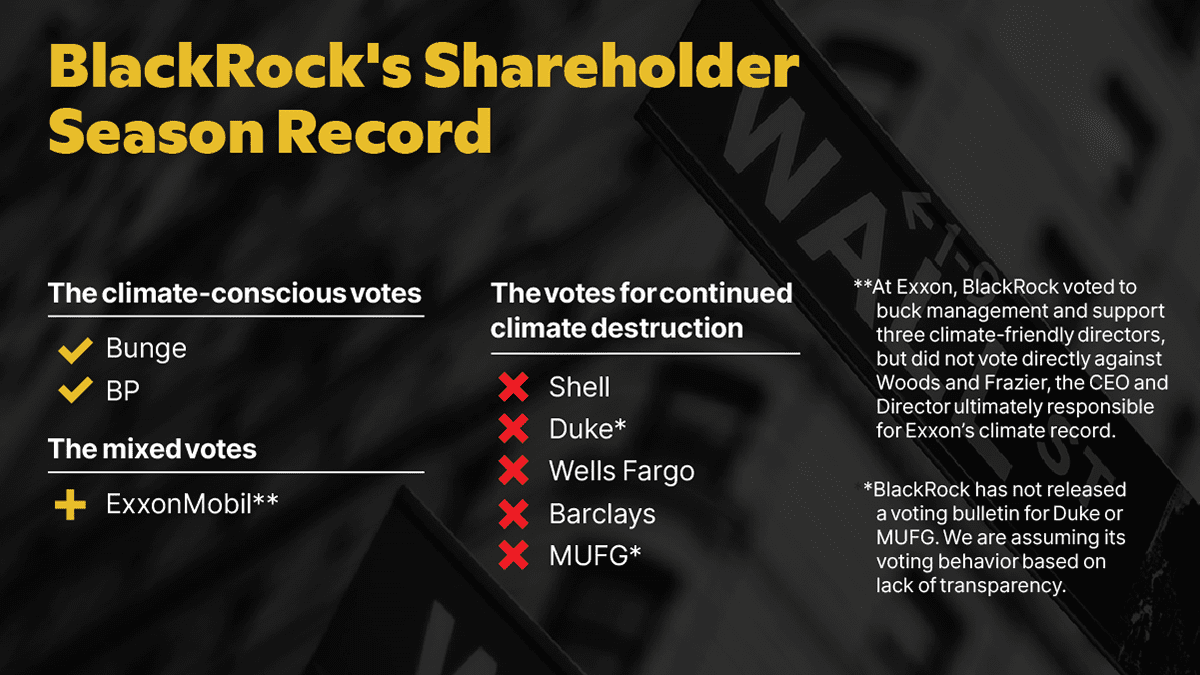

GOOD VOTES: BlackRock voted FOR change at BP and Bunge.

MIXED VOTES: At the contentious Exxon AGM we saw a mixed bag. BlackRock voted for 3 new directors backed by the infamous Engine No.1, but also voted to retain Woods and Frazier, Exxon’s CEO and Lead Independent Director, who have led the company’s ongoing climate denialism and greenwashing.

BAD VOTES: BlackRock voted to retain WellsFargo director Chairman Charles Noski, and voted against a shareholder resolution for Shell to set and publish targets that are consistent with the goals of the Paris Climate Agreement. At Barclays, BlackRock chose to abstain on the Paris Agreement shareholder resolution.

UNDISCLOSED: BlackRock has failed to disclose its votes at Duke and MUFG, therefore we are assuming voted with management.

A note on Vanguard: Vanguard, surprisingly, supported two dissident directors nominated by Engine No. 1 to join ExxonMobil’s board. While we know that Vanguard voted for the status quo at Wells Fargo, the second largest asset manager has been willfully silent and lagging behind its peers this shareholder season. Vanguard has failed to disclose most of its votes and refused to engage with stakeholders and civil society to discuss its position on critical climate votes.

Other notable climate votes this season included Woodside Petroleum where BlackRock opposed a director citing climate concerns, as well as Chevron and ConocoPhillips where BlackRock voted for resolutions for the companies to reduce their emissions.

Given these preliminary results, it is clear that BlackRock performed better than previous years, particularly in the oil and gas sector, but it still largely failed to take action in the critical sectors of utilities and financial services. More astounding still, BlackRock either failed to disclose how it voted, or voted for the status quo, at several companies on its own Climate Focus Universe List (MUFG, Duke, and Barclays to mention a few). According to BlackRock’s strategy, these companies need monitoring and pressure to take action on climate, yet BlackRock failed to use its immense power to push these key companies on its own list toward real action.

Duke, for example, has its share of climate commitments, but has failed to retire its coal plants and has active plans to build new gas plants. Meanwhile, Barclays has increased its financing of key fossil fuel players compared to previous years, in spite of a commitment by the bank to align its business with climate goals. Clearly, these companies don’t have credible transition plans and should be held accountable by shareholders like BlackRock.

So while some progress was made, BlackRock hasn’t yet lived up to the potential of its own rhetoric when it comes to exercising its shareholder voting power. And the votes it did take this spring throw its supposed climate investment strategies into question. When it came to climate issues, BlackRock voted against management at Exxon, BP, and Chevron showing that the asset manager knows these companies are not acting fast enough on climate. Yet these same fossil fuel companies are in BlackRock’s climate transition funds. That’s like failing a student but letting them continue to the next grade anyway.

At the beginning of the year, BlackRock’s CEO, Larry Fink, said in his annual letter to clients, “where we do not see progress in this area [climate], and in particular where we see a lack of alignment combined with a lack of engagement, we will not only use our vote against management for our index portfolio-held shares, we will also flag these holdings for potential exit in our discretionary active portfolios because we believe they would present a risk to our clients’ returns.” This means voting against management and removing companies that do not have credible transition plans from funds in order to push our economy toward climate solutions. At the moment BlackRock is doing neither well.

From the historic heat wave ravaging the Pacific Northwest to the Gulf of Mexico literally burning, the consequences of unending fossil fuel consumption are on full display right now. We are running out of time. What other climate disasters will it take for BlackRock to meet its rhetoric? When will BlackRock finally step up to the visionary action that is needed to avert the worst of the climate catastrophe? The deadline for bold climate action is now, not 2030, nor 2050. Larry Fink and BlackRock knows that, and we will make sure he is reminded of it every day until we see real, all-encompassing action.