With every spring comes shareholder season, when corporations open up to democratic participation from their shareholders during their Annual General Meetings (AGMs). Shareholders vote on resolutions that impact the way companies operate as well as voting to keep or reject boards of directors.

As the world's largest investors, BlackRock and Vanguard have huge power and influence as major shareholders in almost every corporation and this spring they can make or break climate action at major polluters and their funders.

In BlackRock’s 2021 Stewardship Expectations report, the asset manager finally acknowledged that voting against management and supporting shareholder proposals often leads to positive changes at companies. In January 2021, BlackRock expanded its voting criteria and announced that it will hold directors accountable when their companies fail to address climate change in their business plans. In March, both BlackRock and Vanguard joined the Net Zero Asset Managers Initiative, a first move on climate for Vanguard.

While acknowledgments and commitments may mark a change in thinking within BlackRock and Vanguard, it is action that is needed to curb the climate crisis. So this shareholder season, as the world looks toward COP26, the United Nations Climate Change Conference in November 2021, their default position must be to vote in favor of pro-climate shareholder resolutions and against corporate boards when a company doesn’t have a clear climate transition plan.

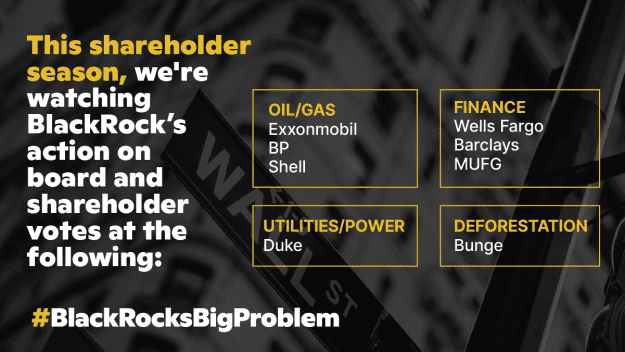

The banking, energy, and utility sectors have the greatest potential to shape corporate climate action and protect long-term shareholder value, and there are climate critical shareholder votes happening in each this spring. There are also critical votes for resolutions pushing companies to end their deforestation, which is the second biggest contributor to climate change and has serious biodiversity and indigenous rights impacts. These are the votes we’ll be watching most closely to see if asset managers like BlackRock and Vanguard are serious about their new climate pledges.

Key Votes to Watch this Shareholder Season

Oil & Gas

ExxonMobil – Vote against directors Chairman/CEO Darren Woods and Lead Independent Director Kenneth C. Frazier for failing to implement plans consistent with limiting global warming to 1.5ºC.

BP – Vote for the shareholder resolution for the company to set and publish targets that are consistent with the goals of the Paris Climate Agreement.

Shell – Vote for the shareholder resolution for the company to set and publish targets that are consistent with the goals of the Paris Climate Agreement.

Utilities and Power Production:

Duke – Vote against director Chair/CEO Lynn Good and Independent Lead Director Michael G. Browning for failing to implement plans consistent with limiting global warming to 1.5ºC.

Financial Services:

Wells Fargo – Vote against director Chairman Charles H. Noski for failing to implement plans consistent with limiting global warming to 1.5ºC.

Barclays – Vote for the shareholder resolution for the company to set and publish targets that are consistent with the goal of the Paris Climate Agreement.

MUFG – Vote for the shareholder resolution for the company to set and publish targets that are consistent with the goal of the Paris Climate Agreement.

Stopping Deforestation:

Bunge – Vote for the shareholder resolution that requests the company issue a report assessing if and how it could increase the scale, pace, and rigor of its efforts to eliminate deforestation in its soy supply chain.

Friends of the Earth US has produced a brief to shareholders outlining exactly why BlackRock has to vote for a deforestation report: Brief to shareholders

At this point, voting with corporate management to maintain business as usual is an active choice against climate action. If asset managers continue to choose not to vote for climate action this shareholder season, they will be actively working against progress, science, and the interests of their own clients and beneficiaries.

For more information on key resolutions and votes, visit www.criticalclimatevotes.com/

For more information on key director votes, visit www.proxyvoting.majorityaction.us/