As the single largest contributor to climate change, coal is responsible for over 30 percent of global carbon emissions. Though there have been substantial shifts away from coal in recent years, asset managers continue to finance this destructive, polluting industry.

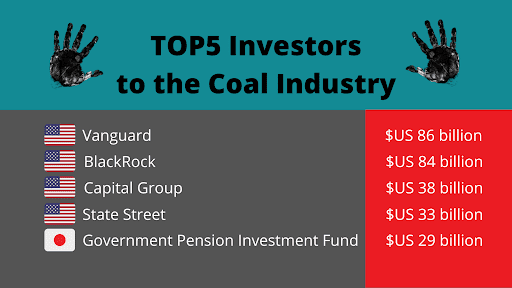

New research released today reveals that US investors, particularly, asset managers, still provide an astounding 58 percent of institutional investments – roughly $602 billion – to the global coal industry. Vanguard shamefully tops the list as the world’s largest investor in coal with nearly $86 billion in investments. This is the first time Vanguard has surpassed BlackRock, a close second with coal holdings valued at more than $84 billion. These two US investment giants collectively account for 17 percent of total institutional investments in the coal industry.

Cutting coal at the scale needed to prevent irreversible climate impact requires one essential task of the financial sector: phase out investments in coal. But doing so effectively can only occur with a thorough understanding of the actors and stakeholders in the coal industry. The Global Coal Exit List (GCEL), produced annually by Urgewald, provides financial institutions with an in-depth analysis of thermal coal-based businesses to screen from their portfolios.

Research conducted by Urgewald, along with Reclaim Finance, Rainforest Action Network, 350.org Japan and 25 other partner organizations, examines data from all 934 companies on the GCEL. By analyzing capital flows, the research identifies the major financiers propping up the global coal industry, including investors, lenders, and underwriters. Despite a surge of lofty net zero goals – including BlackRock’s – and public commitments to exit coal, a staggering 4,488 institutional investors hold over $1 trillion worth of investments in companies involved in thermal coal production, with BlackRock and Vanguard leading the way.

As both the world’s largest asset managers and the world’s largest investors in coal, BlackRock and Vanguard have a moral and fiduciary responsibility to exit coal. While BlackRock has made perfunctory gestures on climate, it must go further to send a signal to the rest of the market that its commitments are not just empty rhetoric. In its latest climate memo, BlackRock stated that “we expect developed markets to be shifting away from reliance on coal as a fuel source,” but it must commit to definitively exiting all sectors of the global coal industry.

Unlike Blackrock, Vanguard has taken almost no action on climate, either in its investments or in its engagement and voting. While Vanguard is the world’s fastest growing asset manager, it has the worst climate voting record among major US-based asset managers with the biggest gap between rhetoric and action. Vanguard’s failure to make any meaningful changes to its portfolio to date puts the company, its clients, the environment, and vulnerable communities at even greater risk.

Today’s groundbreaking data is yet another wake up call for multinational investors like BlackRock and Vanguard. To meet the 1.5º C goals demanded by science, fossil fuels cannot be part of our energy future. Vague promises with undefined net zero frameworks from BlackRock are not enough. Worse still is Vanguard’s complete silence. We need visionary climate leadership, and given these recent findings, BlackRock and Vanguard have the opportunity to demonstrate it. These asset managers must do more.

The time is now to exit all sectors of the global coal industry.

The time is now to remove fossil fuels from active and passive investments.

The time is now to vote for climate resolutions and against directors that are failing to act on climate.

The time is now to act boldly – before it is too late.