Reports

Government & regulations

Reports tracking finance corporations’ lobbying, conflicts of interest, and growing power to influence policy and government decision-making.

A Leaf Out of an Old Book: How the LEAF Coalition Enables Market Colonialism

Amazon Watch has serious concerns that the LEAF Coalition’s agreement with the Ecuadorian Ministry of the Environment is yet another example of carbon offset programs serving as a dangerous distraction from climate justice. Programs like the LEAF Coalition threaten to create a false “green” veneer over continued threats to Indigenous rights while enabling extractive industries and further commoditizing communities’ relationships with nature.

Finance and Climate Change

A comprehensive assessment of the world's 30 largest listed financial institutions shows a clear disconnect between the concrete short-term targets and actions needed to address the climate emergency and the limited, long-term targets currently being set by the financial sector. The research indicates a widespread lack of integration of high-level climate commitments into business segment processes.

Complicity in Destruction IV – How mining companies and international investors drive Indigenous rights violations and threaten the future of the Amazon

This fourth edition of the Complicity in Destruction series, developed jointly by the Association of Brazil’s Indigenous Peoples (APIB) and Amazon Watch, briefly summarizes the history of large-scale mining in Brazil, with particular focus on its encroachment upon Indigenous lands, and highlights the growing momentum that the activity has gained under the Bolsonaro administration. Today, the deadly mining industry continues to cast its shadow over Brazilian Indigenous territories and the Amazon rainforest.

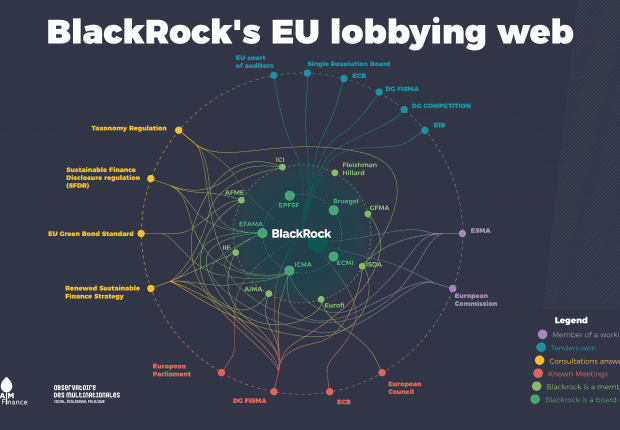

HIJACKED: Exposing BlackRock’s Grip on the EU’s Climate Finance Plans

Reclaim Finance and the Observatoire des multinationales have revealed the extent of BlackRock’s influence over the EU’s climate finance plans. The report, entitled “Hijacked: Exposing BlackRock’s Grip on the EU’s Climate Finance Plans”, finds that the world’s largest asset manager sits at the heart of a lobbying web with privileged access to European institutions. The report raises the alarm on the climate rulebook defended by BlackRock and friend groups. While opposing any kind of (even minimal) climate-related restrictions that would be imposed on financial players and their investment choices, the alternative they push forward is highly problematic.

Fossil Fuel Lobbyists Are Dominating Climate Policies During COVID-19

New research from InfluenceMap shows the oil and gas sector to have dominated climate-related policy battles throughout COVID-19 crisis. Interventions from the industry seeking deregulation and support for fossil fuels in recovery packages have drowned out pro-climate interventions from the non-fossil corporate sector.

The New Money Trust: How Large Money Managers Control Our Economy and What We Can Do About It

This paper will discuss the concerns that the outsized growth of the fund industry, especially its three largest participants, poses for corporate governance, competition, and financial market stability. It then explores some policy solutions to address the financial risks and anticompetitiveimpacts of large asset managers.

How Dodd Frank Can Address Wall Street’s Role In The Climate Crisis

In this paper, Graham Steele argues that a sustainable shift to green energy requires a significant reallocation of this capital and that the Dodd-Frank Act provides the regulatory tools to require financial institutions to internalize the financial risks associated with lending and investments that drive climate change.