Reports

ESG & shareholder proxy voting

Scorecards and analyses of investor voting on shareholder resolutions and board accountability, highlighting gaps between finance leaders’ rhetoric and proxy voting records.

The Asset Managers Funding Climate Chaos: 2022 scorecard on asset managers, fossil fuels and climate change

More than seven years after the Paris Agreement was signed, our 2022 scorecard reveals that the biggest asset managers still have not taken appropriate steps to tackle fossil fuel expansion, a basic prerequisite to keeping global warming in check. While many acknowledge the need to organize a managed decline of the oil and gas industry, these firms are still investing billions into companies whose fossil fuel expansion plans make this objective impossible to achieve.

Climate in the Boardroom: How Asset Manager Voting Shaped Corporate Climate Action in 2021

In 2021, proxy voting by asset managers with over $1 trillion in AUM remained insufficient to the scale and urgency of the climate crisis. Without additional board-level accountability from these largest and most influential shareholders to transition to net-zero pathways, companies in climate-critical industries such as oil and gas, electricity production, and financial services will continue to drive warming beyond 1.5°C—threatening the lives and livelihood of millions and placing trillions of dollars of shareholder value and financial system stability at increasing risk.

2018 Asset Manager Climate Scorecard

A new report analyzing the world’s thirteen largest asset managers’ U.S. proxy voting in carbon-intensive industries reveals that they’re exerting limited and uneven influence over management, despite calls from shareholders to de-carbonize corporate business models.

Sustainable Finance Policy Engagement

This research has mapped out intensive lobbying on European sustainable finance policy, led by industry groups representing the finance and corporate (real economy) sectors. Whilst a small number of financial institutions have pushed for ambitious policy, the majority have remained silent or stated only high-level support.

Voting Matters

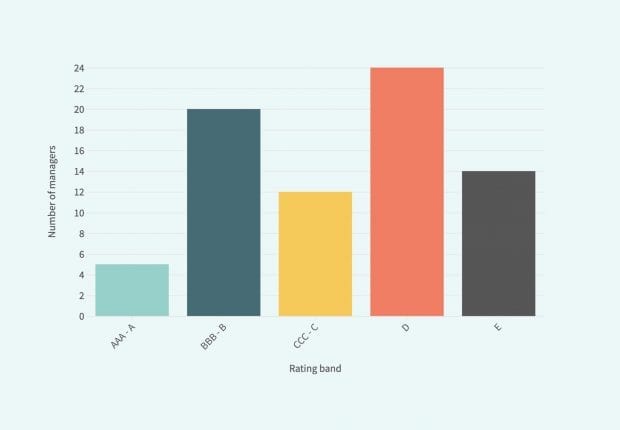

Climate change is one of the highest priorities facing investors. In this report, we’ve examined how 57 of the world’s largest asset managers voted on 65 shareholder resolutions linked to climate change. While there is encouraging improvement when it comes to voting for climate change resolutions, many still shy away from holding companies account. Investors voting power is the most powerful tool they have, it is vital that all investors use it.