ShareAction report finds that the largest US fund managers - including BlackRock - are too cosy with companies on the #ClimateCrisis, and far behind European investors.

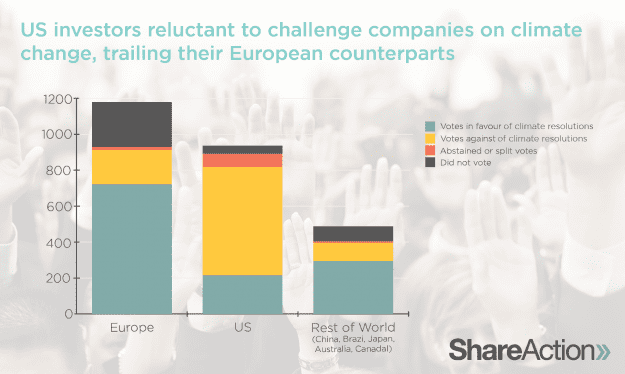

New data reveals that large institutional investors in the US are stalling progress to tackle the social and economic risks of climate change, despite committing publicly to climate action. This is compared to investors in Europe who are more prepared to hold the worst polluters accountable.

Analysis by ShareAction, the responsible investment campaign group, reveals that the largest US asset managers are reluctant to challenge company management on climate issues with their voting decisions. Conversely, the most active and responsible stewards are based in the UK and Europe.

The report looks at shareholder votes cast by 57 of the world’s largest asset managers on a total of 65 proposals that would speed up corporate action on climate change. The range of proposals cover emissions reduction targets, climate reporting and governance, and corporate lobbying.

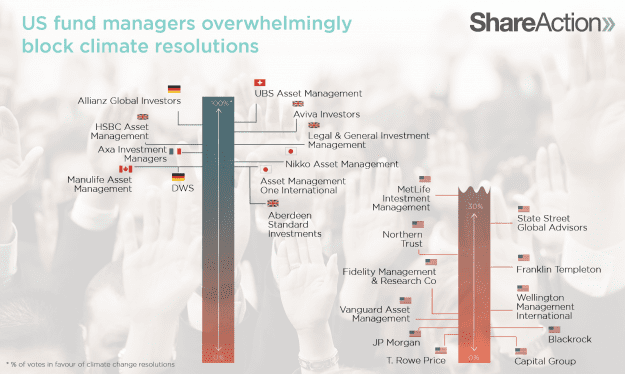

ShareAction finds that the 10 investors that are least supportive of voting for climate action are all based in the US. The five most likely to side with management on these issues are Capital Group, which supported less than 5% of climate proposals analysed, T. Rowe Price (5.3%), BlackRock and J.P. Morgan Asset Management (joint – 6.7%), Vanguard (8.3%), and Fidelity Management & Research Co (9.3%). However, even the second and third best US performers, Fidelity International and Goldman Sachs Asset Management International, supported fewer resolutions than 17 of the 18 European asset managers included in the ranking.

These results are highly concerning, ShareAction says, as the 20 largest US fund managers control about 35% of global assets under management.

Six of the 10 worst performers – BlackRock, J.P Morgan, Fidelity Investments, Wellington Management International, Northern Trust and State Street Global Advisers – have come out in support of the Taskforce for Climate-related Financial Disclosures (TCFD) and joined at least one investor engagement initiative on climate change, yet fail to vote in favour of resolutions on climate-related disclosures.

Jeanne Martin, campaign manager at ShareAction, and author of the report, says: “You can’t boast climate-awareness in public and block climate goals in private. Ultimately, these investors will be judged on their voting, which is the most powerful tool at their disposal. They have the power to put the brakes on the climate emergency, but they’re on auto-pilot, driving us head-on into it. We hope their clients take note of these findings which separate out those who are really walking the walk on climate change.”

The five best performers overall are UBS Asset Management, which supported over 90% of the resolutions in the study, Allianz Global Investors (88.5%), Aviva Investors (86.9%), Legal and General Investment Management and HSBC Asset Management (joint 82%) and AXA Investment Managers (78.7%.) These asset managers are all based in Europe, namely in the UK, France, Germany, and Switzerland.