Dear Ms. Boss and Mr. Galloway:

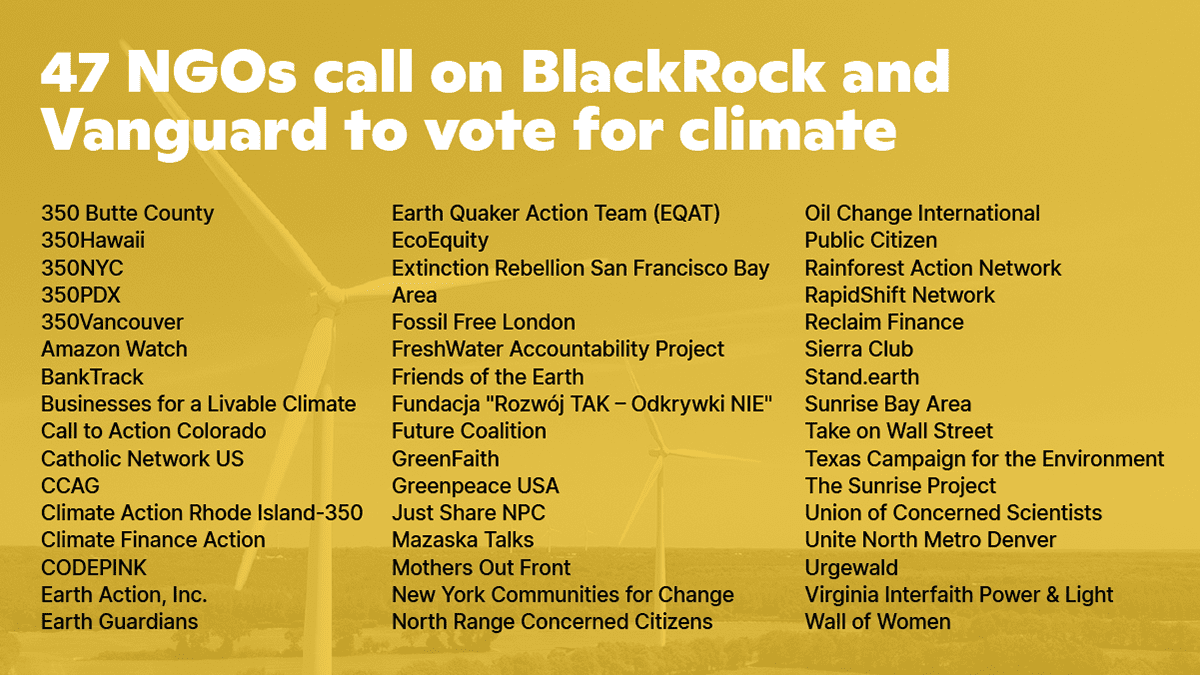

We, the undersigned 47 civil society organizations, with members and supporters representing over 8.2 million people around the world, are writing to convey our grave concerns about the role of BlackRock and Vanguard in exacerbating the climate crisis. This letter outlines our urgent priorities on imminent climate resolutions and boards of director elections. As the heads of investment stewardship, you must make sure your respective companies uphold the climate pledges they have made and vote accordingly.

With over $16 trillion in total assets under management, BlackRock and Vanguard are the largest shareholders in many of the world’s biggest greenhouse gas emitters and their financiers. This distinction carries significant risk and enormous responsibility. As the top two global investors in climate-harming industries, BlackRock and Vanguard have a responsibility to push for long-term climate solutions. Making “financial flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development,” as called for by the Paris Agreement, requires large-scale capital shifts away from high-carbon sectors such as fossil fuels and deforestation commodities. BlackRock and Vanguard specifically, and asset managers more generally, play a critical role in this transition to a sustainable future.

Recent public commitments by your firms and others, arising amidst the Biden administration’s renewed focus on combating climate change, have been significant and encouraging milestones. In its 2021 Stewardship Expectations report, BlackRock finally acknowledged the positive impacts of voting against management and supporting shareholder proposals. In January, BlackRock expanded its voting criteria and announced that it will hold directors of companies accountable for failing to address climate change in their business plans. Furthermore, both BlackRock and Vanguard joined the Net Zero Asset Managers Initiative last month. This was a noteworthy first move on climate for Vanguard, which has mentioned plans to integrate climate into its business decisions.

The steps taken over the past year are a welcome but inadequate move in the right direction. While your pledges may reflect a long overdue shift in thinking within BlackRock and Vanguard, pledges alone are ineffectual without immediate action to curb the climate crisis. Vanguard reported that in both 2019 and 2020 it voted against 94% of shareholder proposals on environmental and social issues. This shareholder season, as the world looks toward the next major UN Climate Conference in Glasgow this November, your default position must be to vote in favor of viable climate shareholder resolutions and against corporate boards when a company lacks a clear climate transition plan that is aligned with the goals of the Paris Agreement.

Though BlackRock and Vanguard have made commitments, real accountability means moving from promises to swift and decisive actions. That means halving global emissions this decade, in part by exiting industries that are incompatible with a 1.5°C pathway, including those dependent on expanding fossil fuels and deforestation. With huge power and influence as major shareholders in nearly every sector, BlackRock and Vanguard must match action to rhetoric and use these new commitments as guidelines for companies operating along various fossil fuel and deforestation value chains. You must demand net zero plans with near-term absolute emissions reductions that are in line with science-based targets—not based on unrealistic and potentially harmful schemes like carbon capture and offsets, which are often associated with serious violations of human rights and Indigenous sovereignty.

The banking, energy, and utility sectors have the greatest potential to shape corporate climate action and protect long-term shareholder value, and there are critical climate shareholder votes happening at companies in each sector this spring. There are also key votes for resolutions pushing companies to end deforestation, which is the second biggest contributor to climate change and has serious implications for biodiversity and Indigenous rights. There are many companies that have zero or inadequate climate transition plans, and you must take action by voting off their lead independent directors. While we will be monitoring all relevant climate resolutions and director votes, these are the priorities we will be watching most closely to see if asset managers like BlackRock and Vanguard are serious about their new climate pledges:

Oil & Gas

- ExxonMobil – Vote against directors Chairman/CEO Darren Woods and Lead Independent Director Kenneth C. Frazier for failing to implement plans consistent with limiting global warming to 1.5ºC.

- BP – Vote for the shareholder resolution for the company to set and publish targets that are consistent with the goals of the Paris Climate Agreement.

- Shell – Vote for the shareholder resolution for the company to set and publish targets that are consistent with the goals of the Paris Climate Agreement.

Utilities and Power Production

- Duke – Vote against director Chair/CEO Lynn Good and Independent Lead Director Michael G. Browning for failing to implement plans consistent with limiting global warming to 1.5ºC.

Financial Services

- Wells Fargo – Vote against director Chairman Charles H. Noski for failing to implement plans consistent with limiting global warming to 1.5ºC.

- Barclays – Vote for the shareholder resolution for the company to set and publish targets that are consistent with the goals of the Paris Climate Agreement.

- MUFG – Vote for the shareholder resolution for the company to set and publish targets that are consistent with the goals of the Paris Climate Agreement.

Stopping Deforestation

- Bunge – Vote for the shareholder resolution that requests the company issue a report assessing if and how it could increase the scale, pace, and rigor of its efforts to eliminate deforestation in its soy supply chain.

At this stage, voting with management to maintain business-as-usual is a deliberate choice against climate action. If asset managers like BlackRock and Vanguard continue to vote against climate action this shareholder season, you will be actively working to undermine climate progress and the interests of your own clients and beneficiaries.

As leaders of some of the largest climate advocacy organizations worldwide, we understand that strong shareholder voting is only one of several things that the top asset managers must do. We urge your firms to begin taking action toward the visionary financial leadership that is needed to meet the scale and urgency of the climate crisis.

As recent signatories to the Net Zero Asset Managers Initiative, BlackRock and Vanguard must demonstrate that they are taking their public commitments on climate seriously. We look forward to learning how you will be voting on these priorities and across the board where climate action and corporate accountability is needed. This shareholder season is a major test, and we will be watching closely.

Sincerely,

350 Butte County

350Hawaii

350NYC

350PDX

350Vancouver

Amazon Watch

BankTrack

Businesses for a Livable Climate

Call to Action Colorado

Catholic Network US

CCAG

Climate Action Rhode Island-350

Climate Finance Action

CODEPINK

Earth Action, Inc.

Earth Guardians

Earth Quaker Action Team (EQAT)

EcoEquity

Extinction Rebellion San Francisco Bay Area

Fossil Free London

FreshWater Accountability Project

Friends of the Earth

Fundacja “Rozwój TAK – Odkrywki NIE”

Future Coalition

GreenFaith

Greenpeace USA

Just Share NPC

Mazaska Talks

Mothers Out Front

New York Communities for Change

North Range Concerned Citizens

Oil Change International

Public Citizen

Rainforest Action Network

RapidShift Network

Reclaim Finance

Sierra Club

Stand.earth

Sunrise Bay Area

The Sunrise Project

Take on Wall Street

Texas Campaign for the Environment

Union of Concerned Scientists

Unite North Metro Denver

Urgewald

Virginia Interfaith Power & Light

Wall of Women