BlackRock must take a stand this shareholder season.

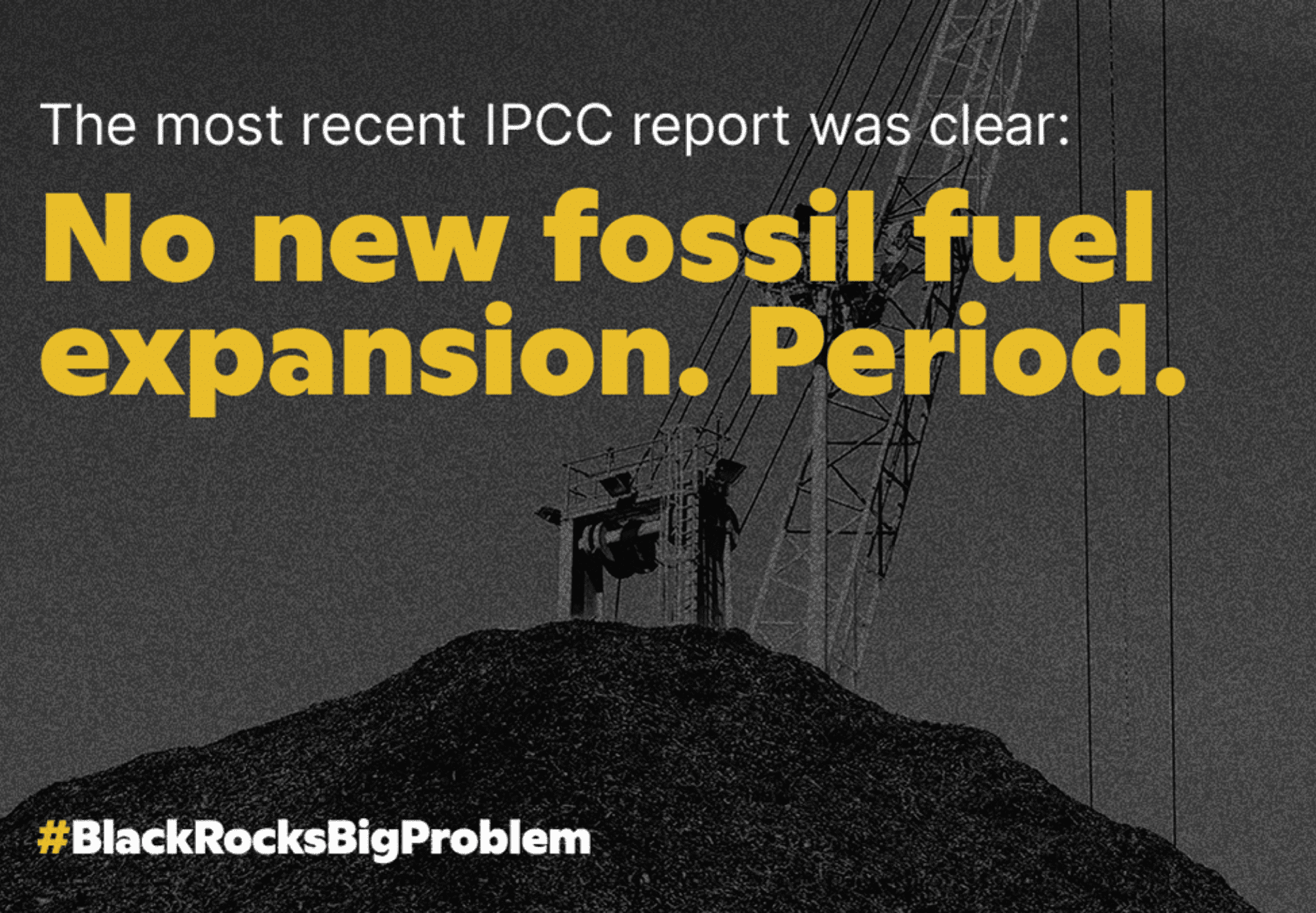

The latest IPCC report centered on the mitigation of climate change has one top-line, red-alert takeaway for BlackRock: expanding coal, oil, and gas production is out of the question. In order to limit global warming to 1.5°C and avert the most devastating effects of climate change, financiers need to immediately stop investing in fossil fuel expansion or the brief window we currently have will close.

BlackRock is a leading shareholder in the world’s top fossil fuel expansionists as well as the banks funding them. The asset manager is therefore in a unique position to hold them accountable this AGM season. If it fails to do so, BlackRock will be complicit in allowing these companies to push us over the brink into total climate catastrophe.

U.N. Secretary-General António Guterres puts it bluntly: “investing in new fossil fuel infrastructure is, morally and economically, folly. These assets will soon be doomed: they will stain the landscape and burden investment portfolios.” He further said, “Some political leaders and business leaders say one thing but do another. In other words, they lie. And the outcome will be catastrophic.”

BlackRock has stated its desire to lead investors in the transition to a decarbonized economy. As a member of the Net Zero Asset Managers Initiative, BlackRock has also pledged to limit emissions in its portfolio accordingly. Whether BlackRock will push back on heavy emitters and their funders this shareholders season will be a litmus test for both its desire to lead and its climate commitments.