Sierra Club finance campaigner Ben Cushing reflects on how our growing movement is starting to move the giants.

2020 was a difficult year in countless ways, but one of the things that fuels my determination as we head into the new year is the momentum we’ve gained in tackling one of the most important yet underappreciated sources of climate destruction: Wall Street.

For years, a small but mighty base of activists worldwide have been tracking and fighting back against the financial sector’s enormous investments in fossil fuels, deforestation, and industries that harm communities and the climate. Over the past few years, the scale and expertise of those efforts has grown—even as the financial industry was slow to respond. But that changed in 2020: The movement reached a new level and began to move many of the largest financiers in the world.

In January, a new coalition was launched to supercharge the climate campaigns targeting different parts of the financial sector—banks, asset managers, insurers, and other institutional investors—by uniting them around a bold and essential demand: Stop the money pipeline that is fueling the climate crisis. As our friend Bill McKibben wrote, “Money is the oxygen on which the fire of global warming burns.” It’s our collective responsibility and opportunity to redirect that oxygen to the communities that desperately need it.

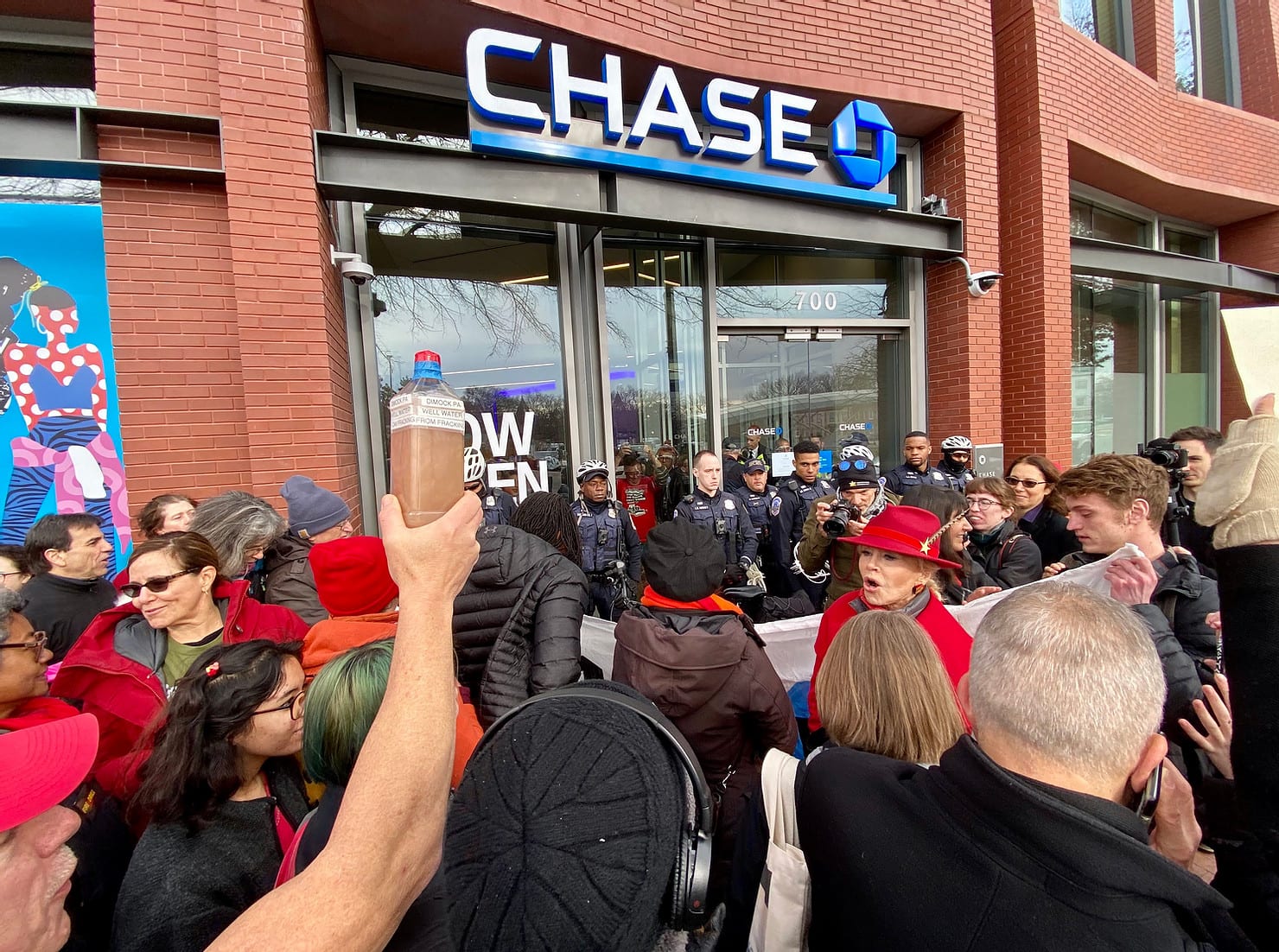

As we entered 2020, the Sierra Club and the dozens of organizations that joined the Stop the Money Pipeline coalition planned to demonstrate at thousands of bank branches and financial headquarters across the country. With the devastating pandemic and economic fallout, much of those plans shifted to online and virtual spaces. But as we know all too well, one crisis doesn’t stop for another. The year’s record-breaking wildfires, heatwaves, and storms made that painfully clear—not to mention the ways dirty fossil fuel projects compounded the pandemic’s severe impacts on vulnerable communities. Therefore, this movement didn’t let up either.

Here are some of the milestones and signs of progress on this campaign over the past year:

- Every major American bank—Goldman Sachs, JPMorgan Chase, Wells Fargo, Citi, Morgan Stanley, and most recently, Bank of America—has said no to funding oil and gas development in the Arctic region, including the Arctic National Wildlife Refuge. Every major Canadian bank has ruled out funding Arctic Refuge drilling, and the total number of global banks that have committed to not fund the destruction of this fragile, special place is now at 30 and counting. These moves have rattled the oil industry and come at a critical time as the Trump administration rushes to auction off the Arctic Refuge coastal plain for drilling, ignoring science and steadfast opposition from the Gwich’in and other Indigenous peoples. Even if some companies are foolish enough to go there, it should be clear that the smart money is staying away. Now, the Gwich’in and their allies are calling on insurance companies to join the banks in avoiding Arctic drilling.

- After coming under intense scrutiny and pressure, the world’s largest asset manager, BlackRock, announced in January that it would put climate change at the center of its business strategy, a move that sent shockwaves throughout the corporate world. In our analysis, there were and still are plenty of unanswered questions about BlackRock’s commitments, which we called out right away. BlackRock is the world’s largest investor in fossil fuels, so its move to begin divesting from coal was major—though it doesn’t go nearly far enough and should be expanded to include oil and gas. As one of the largest shareholders of nearly every publicly traded company, BlackRock has enormous power to support climate action, but it has continued to fall short and undermine progress. We hope that a new set of commitments announced just this month point toward stronger voting actions ahead.

- Even though activists and investors couldn’t attend annual corporate shareholder meetings this spring in person, our movement still showed up in powerful ways to hold Wall Street accountable and push companies to clean up their act on climate. One of the best examples was at JPMorgan Chase, the world’s biggest banker of fossil fuels. Tens of thousands of activists and major investors, including state treasurers, called for the removal of former Exxon CEO Lee Raymond from the Chase board, and half of the bank’s shareholders called for a business plan aligned with the goals of the Paris Agreement. Within a few months, Chase pledged to align its financing with the Paris goals. Lee Raymond was demoted from the lead director position and, just last week, announced he was leaving for good, perhaps signaling that more climate-competent leadership is on the way.

- Around the world, financial institutions have been adopting stronger policies to cut off financing for fossil fuels, a trend that only accelerated this year. Dozens of globally significant banks and other financial institutions have started to exit financing for coal and, increasingly, oil and gas. Financial institutions have also been announcing commitments to reduce the climate impact of their financing and align with the goals of the Paris Agreement. This year, that trend took hold among some of the largest US banks. Morgan Stanley became the first major American bank committed to measuring and disclosing the emissions financed by its loans, investments, and other financial services, and to reaching net-zero by 2050. Citigroup and Bank of America both also committed to measure and disclose their financed emissions, and JPMorgan Chase said it would align its financing with the goals of the Paris Agreement. These policies and others like them are promising but still leave a lot of questions to be answered and work to be done. Investors are demanding more from these banks and others, and civil society groups around the world will be using the Principles for Paris-Aligned Financial Institutions to spell out what true climate leadership from Wall Street would look like.

And now, as we catch our breath and look to the year ahead, more signs of hope and opportunities for bold action are on the horizon. President-Elect Biden will enter office with the strongest climate mandate in US history, and there’s a growing consensus that climate action will be a top priority for every part of the administration—including the Treasury Department and other key financial regulators.

There are both powerful legislative proposals that could curtail Wall Street’s role in the climate crisis and ample existing executive authority that the Biden-Harris administration could use right away to address the systemic financial and economic risks of climate change. The Dodd-Frank Act provides critical ways to move the financial sector in the right direction, and our movement will be pushing the Biden administration to use all the tools at its disposal to ensure that financial institutions zero out their climate impact. As the United States looks to rejoin and go beyond the Paris Agreement, reining in Wall Street will be a key way to demonstrate renewed climate leadership in the lead-up to the next United Nations climate summit in November.

2020 has been a big year in the fight to stop the money pipeline that’s fueling the climate crisis, but we’re just getting started. Though we’ve come a long way already, we have a lot more to do, and the clock is ticking.

Join us and let’s take the fight to a new level in 2021 and beyond.

Ben Cushing is a senior campaign representative leading the Sierra Club’s Financial Advocacy campaign. This was re-posted with permission from the Sierra Club.