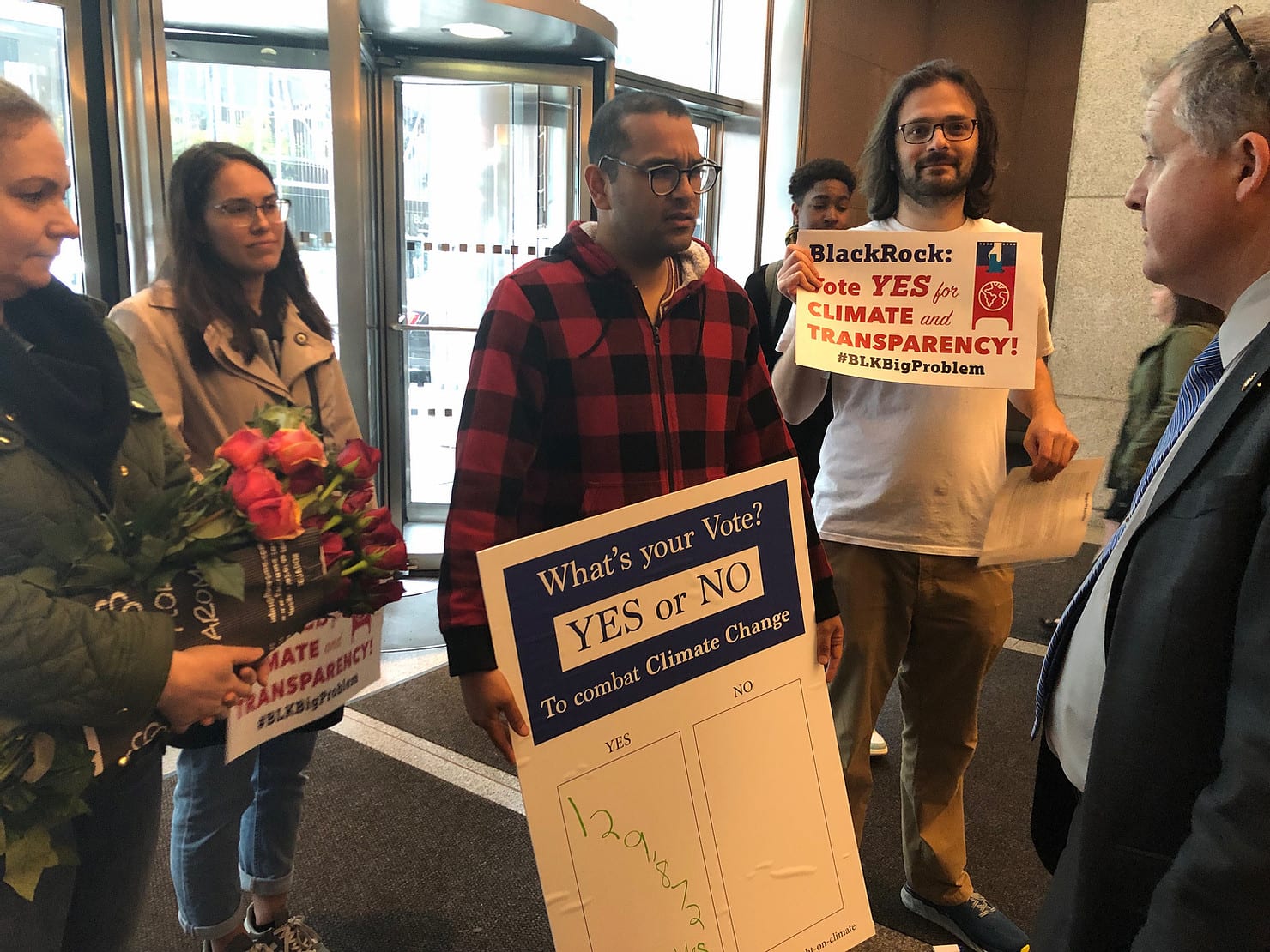

Today in New York City, a coalition of groups led by Majority Action, delivered over

130,000 petition signatures to BlackRock, the world’s largest asset manager and the world’s

largest investor in fossil fuels.

The petition calls on BlackRock, Vanguard and Fidelity to use their immense voting power responsibly by supporting key climate-related shareholder resolutions and voting against directors who are not serving long-term investors’ best interests at nine major upcoming shareholder meetings. Photos from the petition delivery are available here.

The groups, many of which are part of the BlackRock’s Big Problem campaign, are demanding that BlackRock support key shareholder resolutions on climate change and political transparency at various Annual General Meetings (AGMs) in the coming weeks. The companies with critical upcoming key climate votes are Amazon, Anadarko, BlackRock, Chevron, Duke Energy, Dominion, ExxonMobil, Ford, and General Motors. The first of these is Duke Energy this Thursday, May 2nd.

Major fund managers like BlackRock have huge power over the biggest polluters but a terrible track record of holding these companies accountable. BlackRock and other fund managers claim that they’ll use their power to ensure that companies act responsibly on climate, but year after year they vote down climate shareholder resolutions and vote to re-elect business-as-usual directors to fossil fuel company boards. BlackRock’s voting record has left much to be desired, as the fund manager company supported 99% of management-nominated directors at US fossil fuel companies while voting for just 10% of key climate shareholder resolutions. In doing so, they are failing both the planet and long-term investors.

“With control of millions of votes, Larry Fink has unrivaled power to push corporate America to move forward to stop climate change and protect long-term shareholder value. While BlackRock claims to care that companies act responsibly on climate, it is obvious that private dialogue is not yielding results nearly as fast or as ambitious as what is needed to match the urgency of this crisis. Shareholders are clear that the time for engagement without meaningful progress and action must come to an end,” said Eli Kasargod-Staub, Executive Director of Majority Action.

“Major fund managers like BlackRock, Vanguard and Fidelity have huge power over the biggest corporate polluters. That power comes from us – millions of Americans who entrust them with our savings,” said Brandy Doyle, CREDO Action Campaign Manager. “Fund managers claim to care about climate change, but year after year vote down resolutions from shareholders pushing companies to act on climate. They need to stop using our own money against us and start using their power to make real change.”

“BlackRock has an opportunity to use its influence to help tackle the climate crisis by pushing some of the world’s biggest polluters to do better,” said Sierra Club Campaign Representative Ben Cushing. “If it abdicates this responsibility, all of its grand pronouncements about social responsibility are nothing more than empty words.”

“It’s time for Larry Fink to put up or shut up,” said Lukas Ross, Senior Policy Analyst at Friends of the Earth. “Instead of protecting the world’s worst polluters, BlackRock needs to start using its shareholder power to protect future generations. The world’s leading investor in climate destruction can no longer evade responsibility.”

“BlackRock and other asset managers must take this opportunity to be responsible stewards of more than people’s retirement savings — they can can help secure our future by taking a

concrete step to combat climate catastrophe and setting the stage for others to do the same,” said Carolyn Fiddler, Daily Kos Communications Director.

“As one of ExxonMobil’s largest shareholders, BlackRock can and must demand the company and other oil and gas giants stop financing climate misinformation campaigns that downplay the reality and seriousness of climate change and, ultimately, hurt investors’ bottom line,” said Kathy Mulvey, Fossil Fuel Accountability Campaign Director at the Union of Concerned Scientists. “Failure to do so gives the fossil fuel industry a blank check to continue deceptive and harmful practices and threatens the financial security of millions of people. BlackRock’s vote for climate and democracy resolutions at this year’s annual meetings would force ExxonMobil and Chevron to respond to growing investor demands for ambitious action to prevent the worst impacts of climate change.”

“Stop squawking about climate change. Start walking the walk,” said RL Miller, Political Director of Climate Hawks Vote. “Exxon and other fossil fuel companies lied to the American public for decades. Vote to hold them accountable.”

“Millions of Americans entrust fund managers like BlackRock with our retirement savings,” said Moira Birss, Finance Campaign Director at Amazon Watch. “But instead of voting for shareholder resolutions demanding climate responsibility, these fund managers are using their power to block climate action. Our collective future is at stake. It’s time for BlackRock to stop enabling climate change and become part of the solution.”

“BlackRock CEO Larry Fink exhorts other companies to serve a social purpose, but BlackRock needs to get its own house in order first. The company’s record on shareholder resolutions on climate is abominable, one of the worst in the industry,” said Clara Vondrich, Director of Divest Invest. “There’s a reason BlackRock has it’s name: It is the leading investor in coal plants worldwide — including in the Global South where the need to leapfrog dirty development is paramount.”

Press contacts:

- Kari Hudnell, Majority Action, 609-668-0560, kari@abpartners.co

- Josh Nelson, CREDO Action, 202-550-6175, press@credoaction.com

- Gabby Brown, Sierra Club, 914-261-4626, gabby.brown@sierraclub.org

- Carolyn Fiddler, Daily Kos, 202-556-1693, carolyn@dailykos.com

- Moira Birss, Amazon Watch, 510-394-2041, moira@amazonwatch.org

- Erin Jensen, Friends of the Earth, 202-222-0722, ejensen@foe.org

- Ja-Rei Wang, Union of Concerned Scientists, 202-331-6943, jwang@ucsusa.org

- RL Miller, Climate Hawks Vote, 818-518-3470, rlm@climatehawksvote.com

For more information on Blackrock, visit www.BlackrocksBigProblem.com