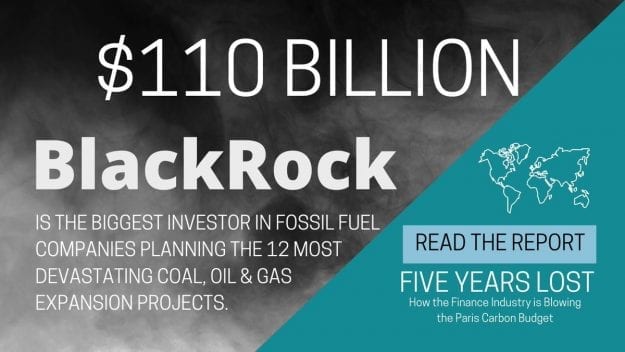

Banks and investors like BlackRock continue to pour billions into the fossil fuel companies developing large-scale, contested coal, oil, and gas expansion projects. In December 2020, on the fifth anniversary of the Paris Climate Agreement, a new report highlighted 12 mega projects that alone will use up 75% of our global carbon budget if we are to limit warming to 1.5 degrees Celsius. BlackRock is the top investor in the report's coal, oil, and gas companies.

The 12 projects highlight the immense environmental damage, violation of Indigenous rights, negative health impacts, human rights concerns, and expected CO2 emissions caused by the continued expansion of fossil fuels. These projects are being pushed forward against local resistance and despite numerous calls from scientists and political leaders to phase out fossil fuels.

BlackRock is the top investor in the report’s coal, oil, and gas companies.

Five of these “carbon bomb” projects where BlackRock plays a significant role include:

- Norway Barents Sea Oil and Gas which reaches into the Arctic Sea. BlackRock is the biggest overall investor in the involved companies

- Mozambique LNG which, in addition to climate impacts, has caused massive human rights violations, including 2,193 people killed and 355,000 fleeing their homes. BlackRock is the largest overall investor in the involved companies

- West Australia Burrup Hub LNG, which will cause four times the emissions of the Adani coal mine and destroy 50,000-year-old Aboriginal art and a coral reef. BlackRock is the largest investor in the project’s leading proponents.

- Guyana-Suriname Basin Oil, off the coast of South America, is one of the biggest fossil fuel discoveries of our time. BlackRock is the largest investor behind oil and gas companies in Guyana and holds the most bonds in oil and gas companies in Suriname

- The Payra Coal Hub in Bangladesh is part of 46 coal-fired power projects still planned in the country that will have major implications for local communities, including premature deaths from air pollution, and the destruction of mangrove forests and fishing grounds. BlackRock is the biggest investor in the involved companies.

Together, these 12 projects are expected to cause at least 175 gigatons of additional CO2 emissions, should they move forward. This is almost half of the 395 gigatons of the remaining carbon budget to limit global warming to 1.5° Celsius with a 50% probability. It is almost 75% of the remaining 235 Gt carbon budget which would provide a 66% probability of limiting global warming to 1.5°C.

Twenty investors provided almost half of the total investments – $535 billion of the total $1.1 trillion – identified in the report. Among the top investors, US financial institutions are clearly leading the list. With bonds and shares worth $110 billion, BlackRock (USA) is the top investor in the report’s coal, oil and gas companies. Vanguard (USA) follows closely behind with $104 billion in bonds and shares. State Street (USA) is in third place with $50.8 billion, followed by Capital Group (USA) with $48.4 billion.

While BlackRock, banks, insurers, and other investors have released a multitude of new exclusion policies and sustainability commitments, these 12 case studies prove that the finance industry is far from truly aligning its business models with the Paris Agreement.

Sustainable investors need to ensure that companies leading new fossil fuel extraction projects do not receive any additional funding, as this further erodes our chances of addressing the climate emergency.