Wall Street's biggest climate destroyer offers sustainable investments - but what are they really selling? Our new report has the answers.

Today we released a new mini-report on BlackRock’s sustainable ESG funds. See the full report here.

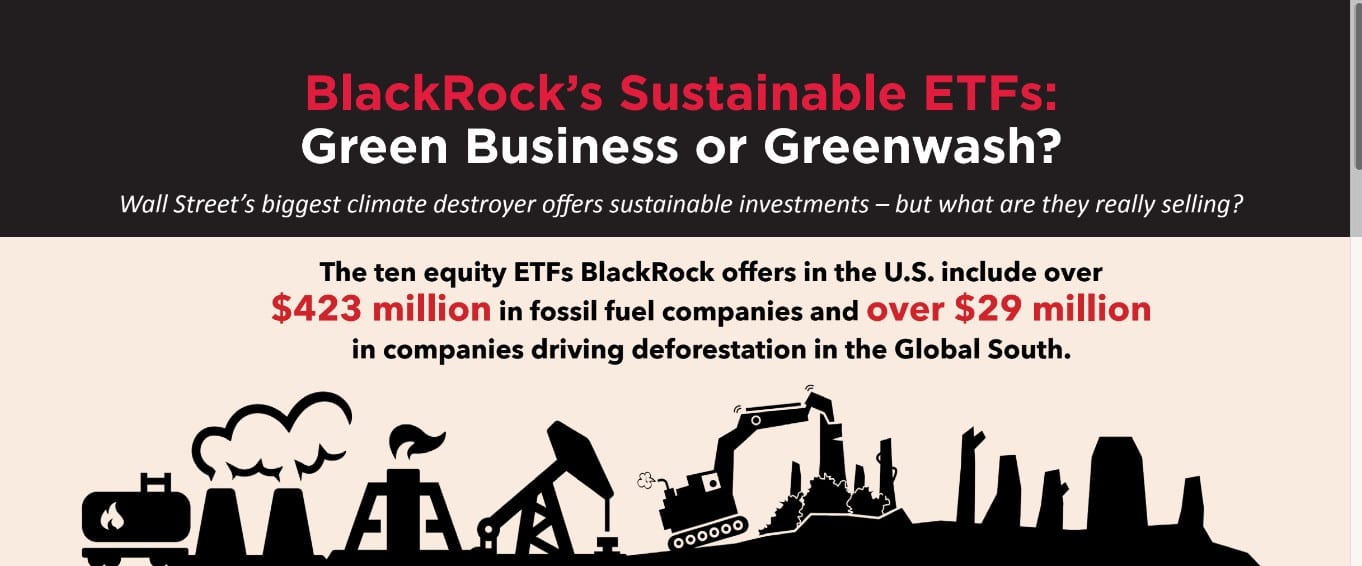

BlackRock is the largest asset manager in the world, with $6.5 trillion under management. Increasingly, BlackRock bills itself as a leader in responsible investing. “Sustainability,” BlackRock says,“is something investors can no longer afford to ignore.” Yet the financial giant has billions invested in the fossil fuel companies polluting the planet and the agribusinesses driving the global deforestation crisis – making BlackRock one of the world’s largest investors in climate destruction.

CEO Larry Fink portrays himself as a model corporate citizen. His annual letters to his fellow CEOs have called on companies to “serve a social purpose” and make a “positive contribution to society.” But despite this rhetoric, BlackRock is the largest global investor in in coal, oil, and gas extraction and the companies building new coal plants, as well as one of the largest investors in rainforest destruction.

BlackRock speaks often about the rising popularity and demand for sustainable investment products and now actively promotes a growing line of “sustainable” funds across different global markets. These funds incorporate Environmental, Social and Governance (ESG) criteria and analysis and are marketed as “sustainable” investment products on BlackRock’s platform.

BlackRock has put particular emphasis on its exchange-trad-ed funds (ETFs), which have become an increasingly popular investment product. These funds bundle together equities or bonds to be traded over stock exchanges. BlackRock markets a handful of its ETFs as sustainable, claiming to recognize “that companies solving the world’s biggest challenges may be best positioned to grow.”

But scratch the surface on BlackRock’s ESG funds and it isn’t hard to see immediate shortcomings and inconsistencies.BlackRock’s “sustainable” funds use different standards that vary depending on region and market, do not consistently screen out companies most responsible for climate change, and lack the level of ambition, integrity, and rigor that should constitute “sustainable” given the urgency of our climate crisis.

Download the full report here: http://bit.ly/BLK_ESG_Greenwash