BlackRock has been under pressure from activists, elected officials, and Indigenous and frontline leaders to adopt policies that match its climate rhetoric and to vote for climate this shareholder season. Analysis of key climate votes this spring shows that BlackRock largely failed to meet its rhetoric.

As the world’s largest investor in climate destruction, BlackRock has been under pressure from activists, elected officials, and Indigenous and frontline leaders to adopt policies that match its climate rhetoric and to vote for climate this shareholder season.

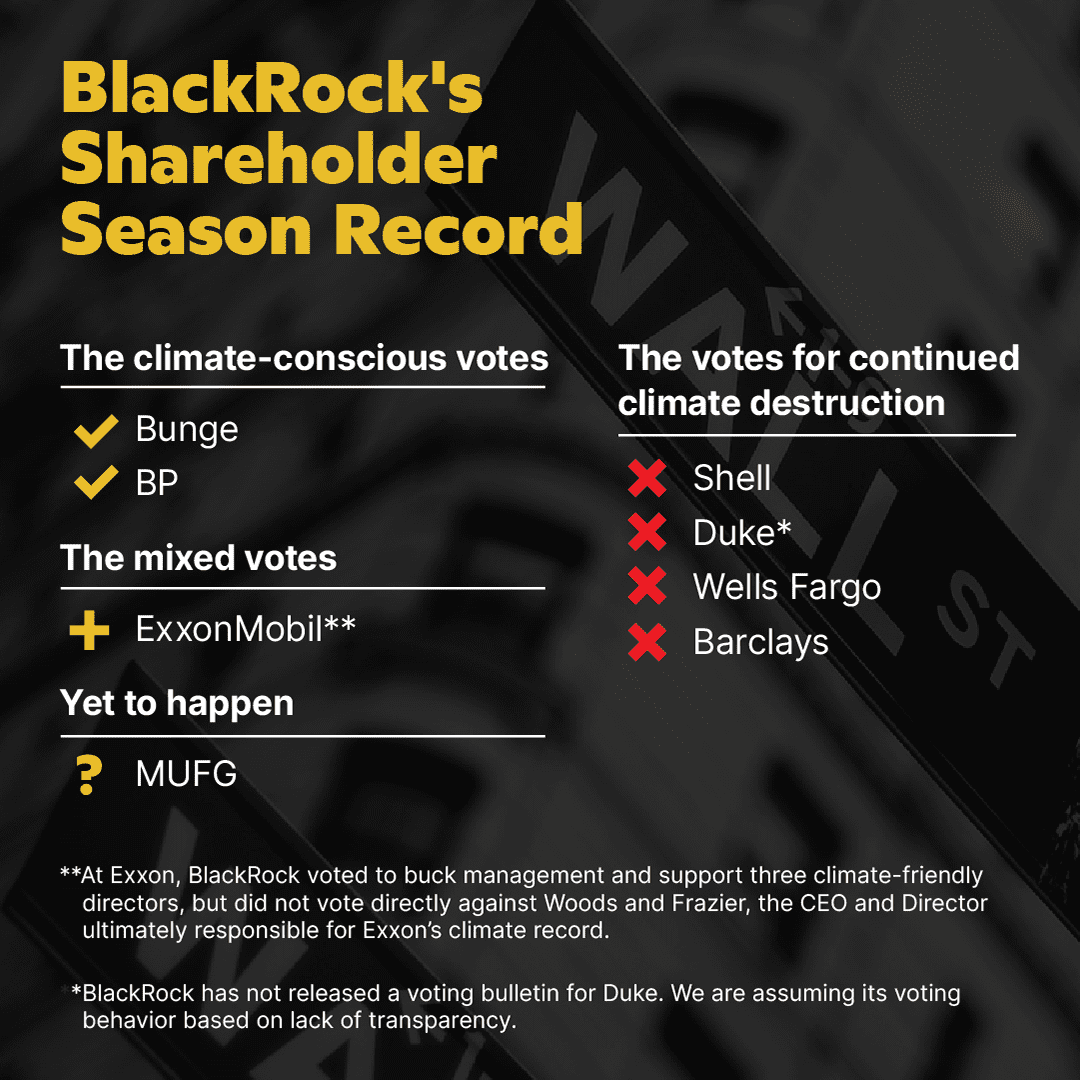

Preliminary analysis of key climate votes this spring shows that BlackRock largely failed to meet its rhetoric. BlackRock seems particularly hesitant to vote against directors at major companies that have failed to implement adequate climate plans. BlackRock’s votes to retain directors (and lack of transparency) at Duke Energy and Wells Fargo were deeply troubling. BlackRock did oppose a director at Australian company Woodside Petroleum, citing climate concerns, leading us to ask whether BlackRock holds smaller companies to a higher standard than it does industry giants.

At the contentious Exxon AGM, BlackRock voted for 3 directors backed by the infamous Engine No.1, but also voted to retain Woods and Frazier, Exxon’s CEO and Lead Independent Director, who have led the company’s ongoing climate denialism and greenwashing. At a company with Exxon’s history, a vote for a few new directors while also supporting the old leadership is a half measure at best.

In an encouraging development in transparency, BlackRock published several voting bulletins on May 28, including its votes at BP and Shell among others. The BP and Shell resolutions saw major increases in investor support over previous years, and BlackRock did the right thing by voting for the climate resolution to bring BP into alignment with the Paris Agreement but oddly didn’t vote for the climate at Shell. BlackRock also abstained on a similar resolution at Barclays (learn more about Barclays vote here).

With the news on BP, BlackRock has performed better than previous years but it is still largely failing to take responsibility for its oversized role in fueling the climate crisis. We’d expect this kind of failure from Vanguard, a prominent fossil fuel investor and the only asset manager that beats BlackRock in coal holdings, but it is even more troubling when BlackRock and its CEO Larry Fink commit to bold climate action but largely fail to rise to the occasion.

Where are the rest of BlackRock’s climate plans?

We have watched BlackRock’s actions since January 2020 and so far they are not even close to enough to solve BlackRock’s climate problem. IEA Director Fatih Birol stated “continuing to put money into oil and gas projects may be junk investments and it could throw domestic climate targets off course.” Between their roadmap and our own metrics it’s clear that BlackRock is not moving quickly or boldly enough toward a low carbon economy.

BlackRock holds $3.7 billion in just three tar sands pipeline companies, and still had $85 billion invested in coal as of October 2020, $24 billion of which are held in companies planning to expand their coal business. According to a report by Urgewald, BlackRock is the leading investor in the companies driving 12 of the most devastating fossil fuel expansion projects of our time. To top it off, BlackRock’s Lead Independent Director Murry Gerber has extensive financial ties to the fossil fuel industry, which were recently exposed.

But BlackRock is trying to put on a sustainable face. In early April, it launched a new “carbon transition readiness” fund that broke records, drawing $1.25 billion in investment at launch. But the fund is swimming in Big Oil. It includes Exxon, Chevron, ConocoPhillips, Marathon Petroleum, and Devon Energy; fossil-fired utilities including Berkshire Hathaway, Consolidated Edison, and UGI; and oil field services and pipeline companies including Kinder Morgan, Baker Hughes, and Schlumberger. To call a fund like that “carbon transition” is a misnomer at best, and outright deception at worst.

So what can BlackRock do?

BlackRock is coming up short on climate so far, but it can change. It needs to start by releasing concrete near-term plans that contribute to significant reductions in greenhouse gas emissions.These climate plans must center justice, meet or exceed science-based interim targets aligned with the 1.5 degree goal of the Paris Agreement, and not rely on false climate solutions like carbon offsets.

That means ending financing of fossil fuels and companies perpetuating the destruction of our forests. And true climate leadership means promoting and respecting Indigenous rights by adopting policies to hold companies accountable for Indigenous and human rights abuses. And of course, BlackRock must exercise the full extent of its shareholder power to push for real climate action at companies across our global economy.

Learn more about climate solutions for asset managers here.

2021 has come with a lot of rhetoric and some small steps from BlackRock, but we are running out of time. Will BlackRock step up to the visionary action that is needed to avert the worst of the climate catastrophe? That’s up to Larry Fink, and he knows that we will continue to hold him and the financial giant he has created accountable.