Five of the world's most powerful financial institutions are actively contributing to climate change by providing debt and equity financing for crude oil extraction projects in the Amazon. BlackRock is one of them.

Tens of millions of acres of Indigenous Amazonian territories and isolated rainforest are slated to be auctioned off for new oil drilling in the western Amazon, threatening the most biodiverse rainforest in the world and the survival of the indigenous peoples who live in it, and paving the way for catastrophic global climate change.

The Amazon rainforest is essential in mitigating climate change. It absorbs approximately 2 billion tons of CO2 per year (5 percent of global emissions), and although it covers only 4 percent of the Earth’s surface, it contains 33 percent of the world’s plant and animal biodiversity. The rainforest is a part of the Earth’s natural thermostat, driving weather patterns and regulating global climate temperatures. Making up 1/5 of the rainforest, the western Amazon region spans Colombia, Ecuador and Peru, and is home to almost 1/2 of the Amazon’s indigenous peoples. Indigenous peoples protect this ecological abundance, which boasts the highest concentration of biodiversity found anywhere in the Amazon. The western Amazon also contains oil and gas deposits, many of which sit below ancestral indigenous territories.

This report outlines in detail the ways that five of the world’s most powerful financial institutions are actively contributing to climate change by providing debt and equity financing for crude oil extraction projects in the Amazon. It highlights key examples of on-the-ground indigenous resistance to oil extraction, while making clear that this extraction in the Amazon is not only terrible for the climate but also a major financial risk for these institutions, given the precedent of legal resistance and forceful intervention from indigenous communities. In the past three years alone, these five financial institutions have made available tens of billions of dollars for oil companies operating in the Amazon, including GeoPark, Amerisur, Frontera, and Andes Petroleum.

The five financial institutions investigated in this report are:

Citigroup (Bank & Asset Manager): Amazon Watch research found that between (Q3)2017-(Q4)2019, Citi contributed $827 million in debt financing to enable regional expansion of Amazon crude oil operations for Geopark, Frontera Energy, and Andes Petroleum.

JPMorgan Chase (Bank & Asset Manager): Amazon Watch research found that as of (Q4)2019, JPMorgan Chase holds $401 million of stocks and bonds in Geopark, Frontera Energy, and Andes Petroleum, and that between (Q3)2017-(Q4)2019 the bank contributed $490 million in debt financing to enable regional expansion of these companies’ operations, bringing its total contribution to Amazon crude oil extraction to over $890 million.

Goldman Sachs (Bank & Asset Manager): Amazon Watch research found that between (Q3)2017-(Q4)2019, Goldman Sachs contributed $998 million in debt financing to enable regional expansion of Amazon crude oil operations for Andes Petroleum and Geopark, and that as of (Q4)2019 holds $25 million of stocks and bonds in the two companies, bringing its total financing of Amazon crude oil to a grand total of over $1 billion.

HSBC (Bank and Asset Manager): Amazon Watch research found that as of (Q4)2019, HSBC holds $595,000,000 in stocks and bonds in Geopark and Andes Petroleum, and that between (Q3)2017-(Q4)2019 contributed $648 million in debt financing to enable regional expansion of these companies’ oil operations. This brings HSBC’s total contribution to Amazon crude oil extraction to over $1.2 billion.

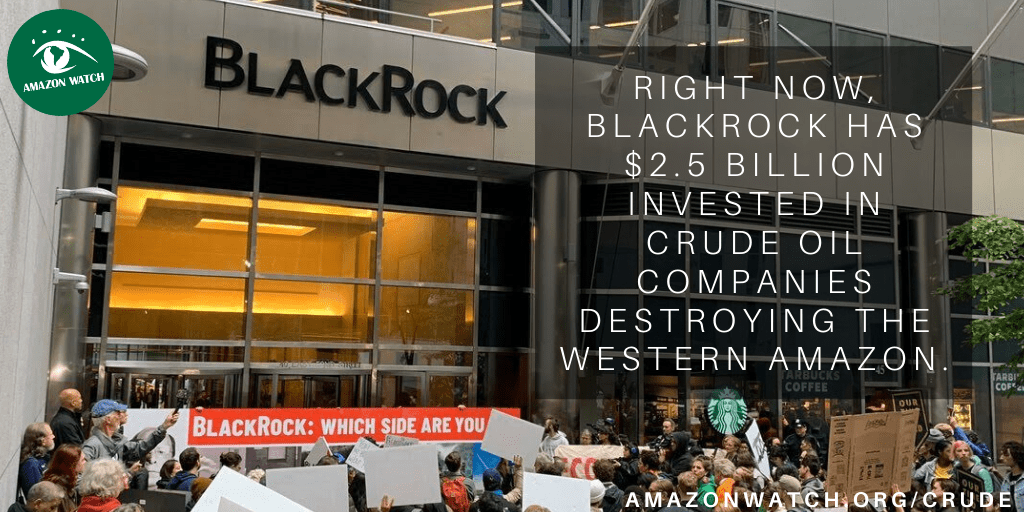

BlackRock (Asset Manager): As of (Q4)2019, BlackRock holds $2.5 billion of stocks and bonds in Geopark, Frontera Energy, and Andes Petroleum. BlackRock previously held a position in Amerisur as of (Q2)2018, but sold it in late 2018.

Although many of these financiers have publicly expressed commitments to environmental and social corporate responsibility and to climate initiatives like the Paris Agreement, they continue to finance the destruction of the Amazon and the violation of indigenous territorial rights. Because of their complicity in the human rights violations and climate chaos inherent in oil extraction in the Amazon rainforest, they have fallen under scrutiny from environmental and human rights advocacy groups. Amazon Watch, in collaboration with a coalition of other climate conscious organizations, is targeting these actors with a new campaign called Stop the Money Pipeline, calling for a radical shift in the finance industry away from fossil fuels and deforestation and towards a just, clean-energy transition.