Last week, an extensive piece of research that looks at the financiers behind the world’s coal companies revealed that BlackRock and Vanguard are still the leading investors in coal.

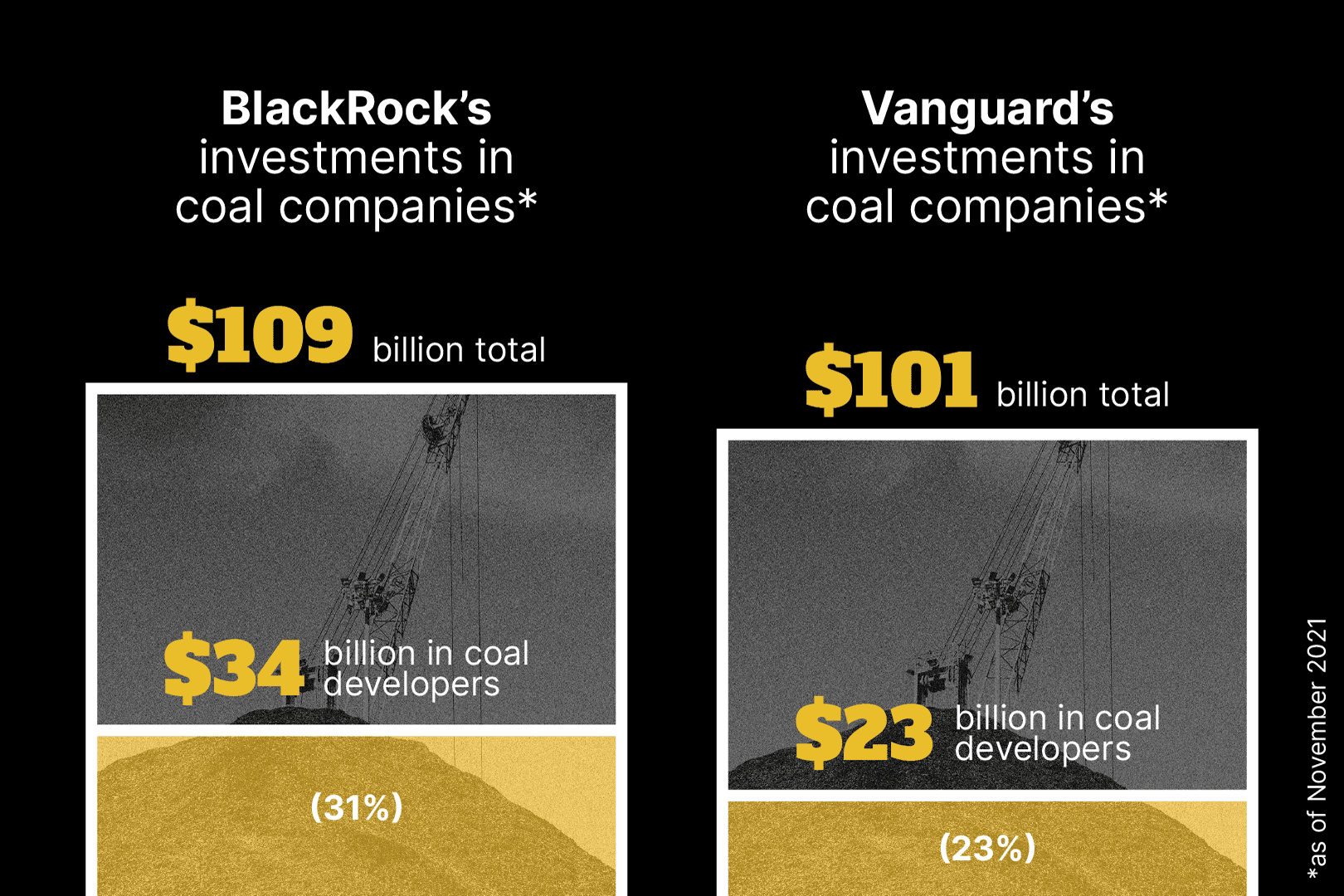

With a whopping $109 billion worth of bonds and shares in global coal companies, BlackRock tops the list, followed by Vanguard, with a sizable $101 billion. Unfortunately, this doesn’t come as much of a surprise. The two asset managers’ investments in the coal industry are part of the reason why the BlackRock and Vanguard’s Big Problem campaigns were started. For years we have been telling these financial behemoths that their massive exposure to climate destructive industries is driving all of us closer to the edge of climate collapse.

What is very concerning news, however, is just how large the two investors’ bond and shareholding in coal developers still is more than 6 years after the Paris Agreement, two years after Larry Fink pledged that BlackRock would divest from thermal coal, and almost one year after both BlackRock and Vanguard joined the Net Zero Asset Managers Initiative. But more about that later.

Let’s take a closer look at coal developers first. Coal developers are companies that are planning to significantly increase how much coal they mine, sell, transport, burn – or all of the above – usually for years into the future. If there is a textbook definition of *not* intending to transition towards a decarbonized economy, it is planning to construct a brand new coal plant. And yet, BlackRock and Vanguard have sizable investments ($34 billion and $23 billion respectively) in these coal expansionists and are often their leading investors, like in the case of BHP Group, Glencore, Eskom, or China Huaneng. For Vanguard, investments in coal expansionists make up close to a quarter of its total investments in coal companies, for BlackRock it is shockingly almost a third. You can read more about the coal companies in question on coalexit.org.

Now for the “net zero” part: what’s so stunning about all of this is that both BlackRock and Vanguard are members of the Net Zero Asset Managers Initiative. The NZAMI is an alliance of asset managers “committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5 degrees Celsius; and to supporting investing aligned with net zero emissions by 2050 or sooner.”

Climate science authorities like the IEA and the IPCC have made it abundantly clear that in order to stay within 1.5 degrees of global warming, we need to stop expanding fossil fuel production immediately. Despite their public pledges to support the 1.5 degree goal, BlackRock and Vanguard are not just continuing to provide a lifeline to the most harmful of polluting industries. They are actually investing in the companies expanding their coal business. One doesn’t need to be a climate scientist to realize that something is off here. The coal expansion that BlackRock and Vanguard are enabling is entirely at odds with what is necessary to prevent total climate collapse and will dangerously delay the transition to a decarbonized economy. A transition, which BlackRock itself recently stated is already underway.

As Yann Louvel with Reclaim Finance and one of the analysts behind the Global Coal Exit List says: “No one should be fooled by BlackRock and Vanguard’s membership in the Net Zero Asset Managers Initiative. These two institutions have more responsibility for accelerating the climate crisis than any other institutional investor worldwide.”

But where do we go from here? BlackRock, Vanguard, and the rest of the finance industry must commit to immediately cease funding fossil fuel expansion. This is the bare minimum of what climate scientists say is necessary to prevent the 1.5 degree goal from slipping out of our reach. It should also be a given for every financial institution that has made any form of public climate pledges. Anything else would not just be a breach of those pledges, it would also mean game over for a livable planet.